- Work & Careers

- Life & Arts

Revealed: the Alameda venture capital portfolio

- Revealed: the Alameda venture capital portfolio on x (opens in a new window)

- Revealed: the Alameda venture capital portfolio on facebook (opens in a new window)

- Revealed: the Alameda venture capital portfolio on linkedin (opens in a new window)

- Revealed: the Alameda venture capital portfolio on whatsapp (opens in a new window)

Kadhim Shubber and Bryce Elder

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

As well as running a crypto exchange that didn’t exchange crypto and owning a hedge fund that didn’t hedge , Sam Bankman-Fried had a venture capital fund that didn’t venture its own capital.

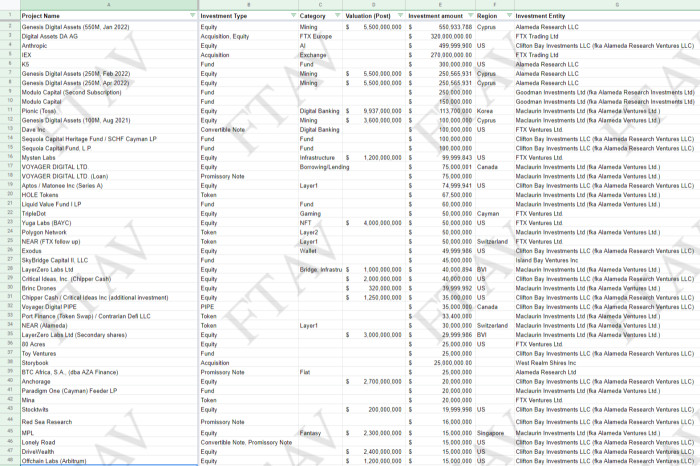

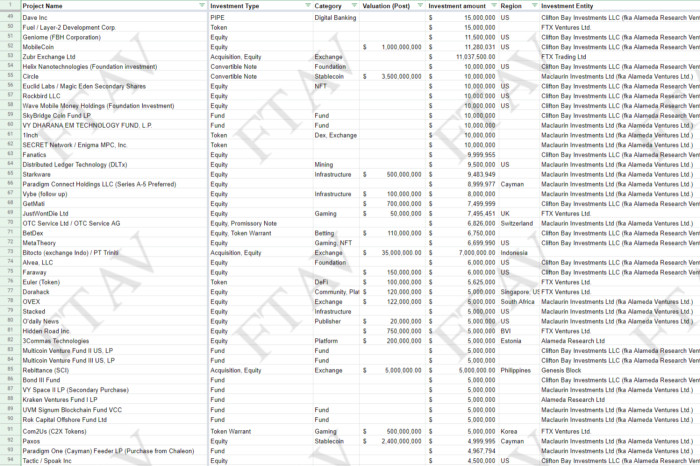

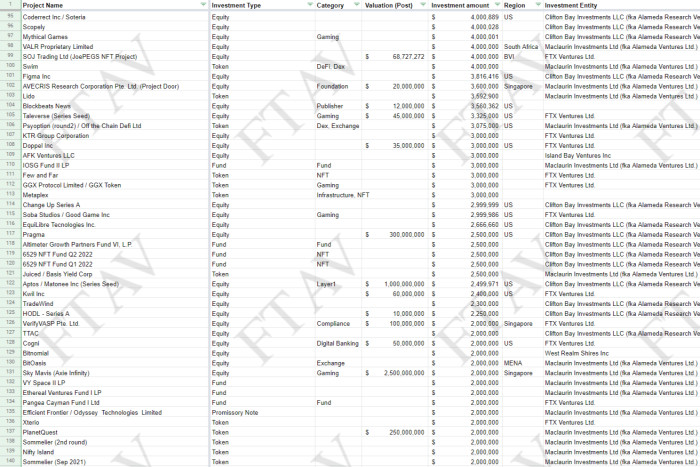

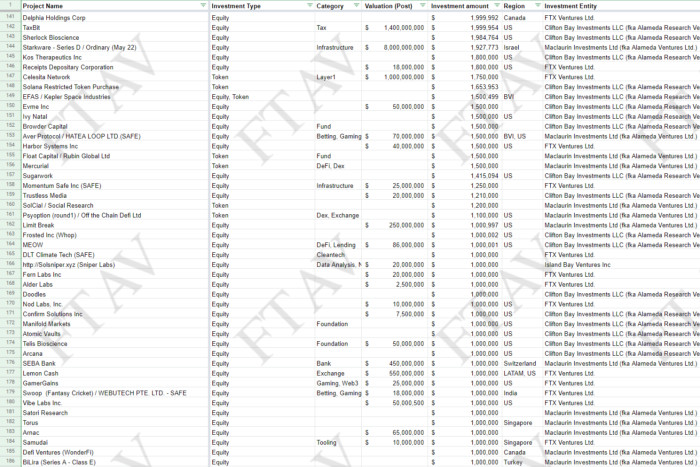

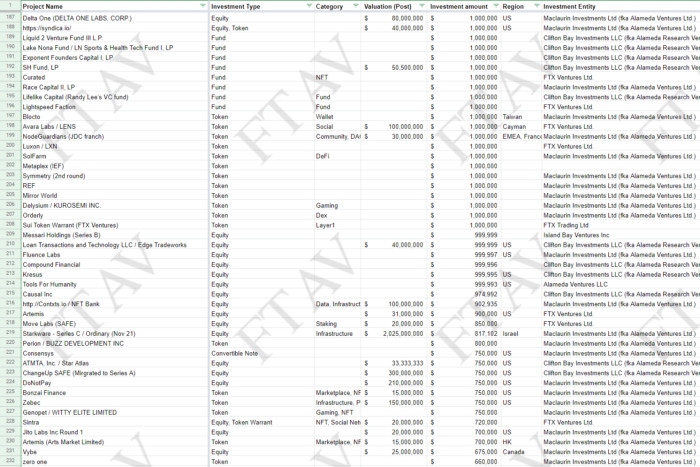

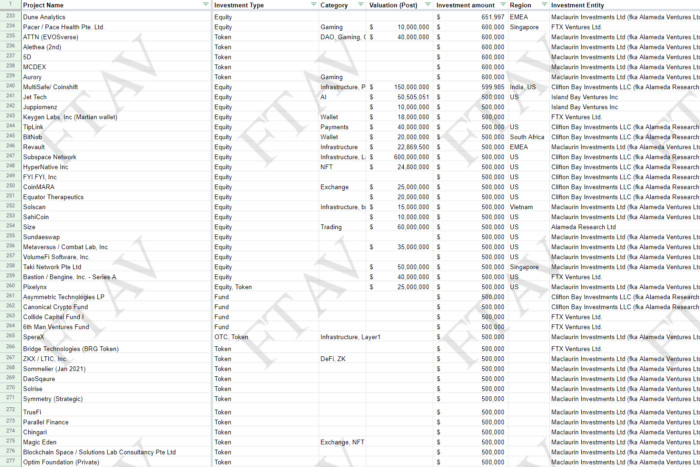

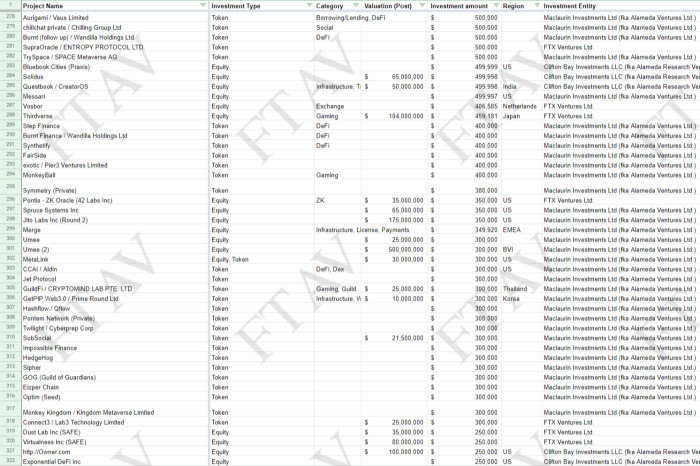

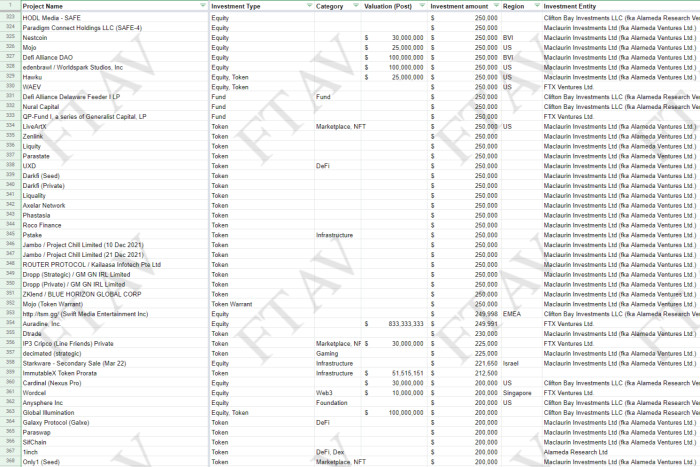

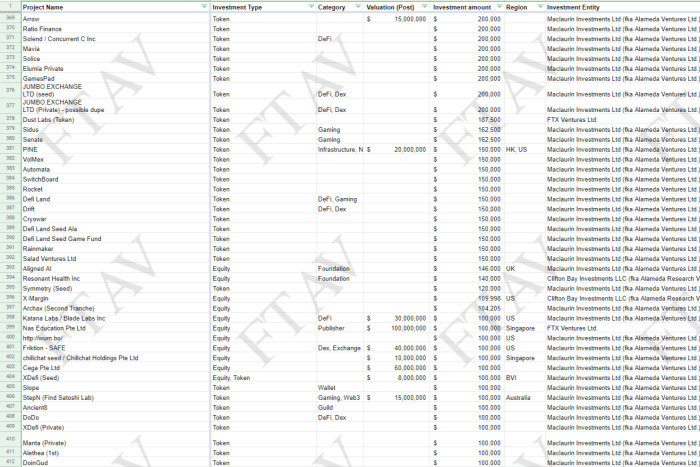

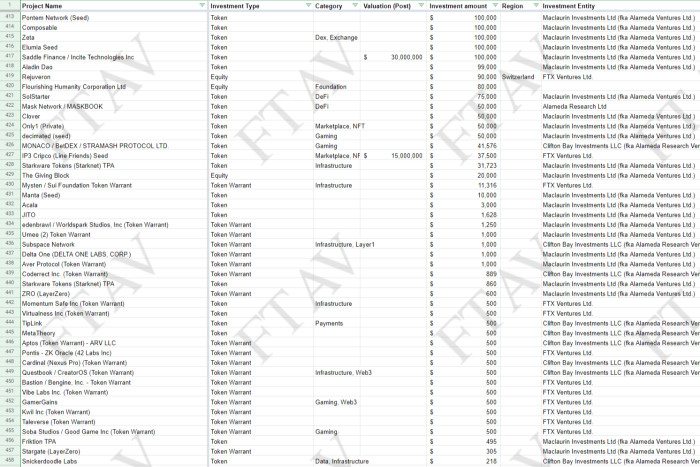

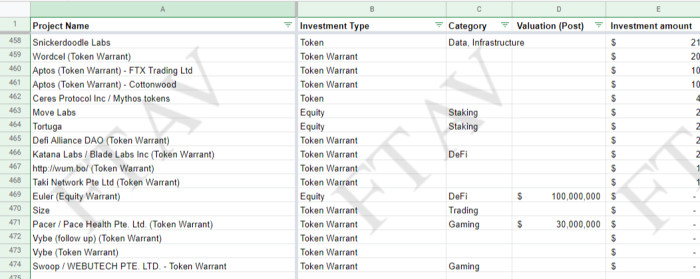

The VC division, in contrast to the rest of the FTX group , can now provide some insight into where some of the money went. Here’s where it went:

The screenshot above and all those below are taken from an Excel spreadsheet dated early November, when SBF was seeking rescue funding amid a run on FTX customer deposits. Mobile and app users are advised to click the magnifying glass below each image for more detail.

According to a person familiar with the rescue effort, the document shows an Alameda Research private equity portfolio — with some FTX bets mixed in — that was being offered as collateral in an attempt to secure a new credit line for the stricken group.

The disparate bundle of nearly 500 illiquid investments is split across 10 holding companies. The total investment value is given on the spreadsheet as in excess of $5.4bn.

As well as forming a central plank in efforts to maximise recoveries from FTX’s bankruptcy, the portfolio might offer regulators insight into whether the group’s trading and exchange businesses were ever operationally separate as claimed.

Bankman-Fried conceded in an interview with the Financial Times that he was involved in Alameda’s venture capital activities but has so far ducked questions around the misuse of FTX customer funds.

Going by the spreadsheet, boundaries between SBF’s companies were blurred. Two of Alameda’s biggest holdings, the crypto miner Genesis and the artificial intelligence research group Anthropic, are also listed on the draft FTX balance sheet published last month by FTAV. (Semafor subseqently reported that FTX had seized certain assets from Alameda after a margin call.)

As previously reported, the portfolio includes stakes in FTX backers Sequoia Capital and Anthony Scaramucci’s SkyBridge Capital , as well as in Elon Musk’s SpaceX and Boring Company projects through the investment in K5.

Of Alameda’s remaining investments, crypto and DeFi projects account for the majority. But the list also includes numerous start-up video game studios and betting platforms, online banks, publishers, a fertility clinic , a military drone maker and a vertical farming company ,

Some entries have no clear link to an active business, suggesting they may be misspelt or mislabeled.

Note that FT Alphaville has excluded entries where an investment type is not given, which removes approximately a dozen names with a total stated investment of about $100mn. All other data are presented as they were shown to prospective FTX investors. The FT makes no claim as to the data’s accuracy or completeness.

When asked about why FTX used customer funds to prop up Alameda, SBF has repeatedly pleaded ignorance. The former FTX CEO said that to avoid conflicts of interest he chose not to get involved in Alameda’s trading and risk management, so before last month was not fully aware of its parlous state.

However, SBF told the FT that in early summer he had participated in conversations where Alameda’s financial health and borrowing were discussed. The venture capital investments Alameda had made were “effectively, some of them, on margin”, he added.

Alameda’s spreadsheet predates SBF’s current media blitz by a month, though it comes with all the same warnings about potentially selective recall and unreliable presentation, As the FT’s Joshua Oliver reports:

Bankman-Fried’s attempt to account for what went wrong was laced with caveats and references to his incomplete memory. He cited lack of “confidence” in his answers at least a dozen times, calling other responses “idle speculation” or “shitty answers”. At one point, he paused for half a minute with his head in his hands.

Caroline Ellison, former CEO of Alameda and SBF’s one-time romantic partner, could not be reached for comment.

Promoted Content

Follow the topics in this article.

- Financial services Add to myFT

- FTX Trading Ltd Add to myFT

- Alameda Research Add to myFT

- Sam Bankman-Fried Add to myFT

- FT Alphaville Add to myFT

- Cryptocurrency

The Bombshell Evidence That Led to Sam Bankman-Fried’s Conviction

I t took exactly one year for Sam Bankman-Fried to transform from beloved billionaire entrepreneur to convicted felon.

On Nov. 2, a New York jury found Bankman-Fried guilty on all seven counts he was charged with by the Department of Justice, including defrauding customers and investors of his crypto exchange FTX. Bankman-Fried, the jurors decided, was part of a conspiracy to extract more than $8 billion from FTX customers and funnel it to his trading firm Alameda Research, which then spent it on Bahamian real estate, startup investments and political donations.

The jury’s decision comes exactly one year after Bankman-Fried’s empire first started to crumble, when the crypto outlet Coindesk published a leaked balance sheet from Alameda Research. The balance sheet appeared to show that Alameda was in much worse financial shape than it had let on. Fears about FTX’s solvency quickly mounted, with customers withdrawing billions of dollars. But FTX, it turned out, did not have the funds to pay them back, and the company declared bankruptcy less than two weeks later.

Since then, Bankman-Fried has consistently denied that he misused customer funds. He pleaded not guilty and testified of his innocence last week in a Manhattan courthouse. But the jury was not convinced. It took them less than five hours for them to find him guilty on all counts.

Bankman-Fried faces up to 120 years in prison and will be sentenced by Judge Lewis Kaplan at a later date.

Mark Cohen, Bankman-Fried’s lawyer, responded to the verdict in a statement: “We respect the jury’s decision. But we are very disappointed with the result. Mr. Bankman-Fried maintains his innocence and will continue to vigorously fight the charges against him.”

The government’s case against Bankman-Fried centered upon the testimony of Bankman-Fried’s inner circle: his former closest collaborators, who all took the stand to allege that he directed them to commit fraud in order to steal billions from customers.

Here were the most consequential and shocking pieces of evidence presented over the course of the trial, which shed light on Bankman-Fried's fraudulent empire.

Alameda Research had been taking FTX customer deposits for years.

A little less than a year ago, the cryptocurrency exchange FTX collapsed , as its users tried to collectively withdraw billions of dollars but were unable to do so. It was soon revealed that the money had ended up in the coffers of Alameda Research, Bankman-Fried’s trading firm, which made enormous bets on various parts of the crypto ecosystem.

This was nothing new. In fact, FTX co-founder and executive Gary Wang testified that, from FTX’s inception in 2019, customer funds had always flowed straight to bank accounts owned by Alameda, which was then able to do as it pleased with the money. That year, Wang hard-coded an exception into FTX that made Alameda the only user on the exchange allowed to have a negative balance—i.e., to borrow from customer funds. Wang says that Bankman-Fried directed him to create that exception.

This borrowed money was then deployed across the world, alleged Professor Peter Easton, an accounting professor at Notre Dame and expert witness called by the prosecution. During his testimony, Easton displayed analysis that appeared to show that billions of customer funds were taken and reinvested in Bahamian real estate (including the $30 million penthouse Bankman-Fried lived in), crypto startups, and political contributions. (On Oct. 31, however, Bankman-Fried said he didn’t “necessarily agree” with the veracity of the exhibit.)

Bankman-Fried has conceded that Alameda borrowed FTX customer funds—and has stated that he believed Alameda was allowed to do so, as long as its value was net-positive.

When FTX crashed, Bankman-Fried allegedly misled users about the financial state of the company.

On Nov. 7, 2022, Bankman-Fried tried to reassure his customers of his flailing exchange by tweeting out, “FTX is fine. Assets are fine. FTX has enough to cover all client holdings.”

But the previous day, Bankman-Fried had created a Google Doc, which was presented in evidence, in which he wrote that FTX had “enough to process ⅓ of remaining client assets.” And on the morning of Nov. 7, he sent a Signal message to FTX’s inner circle in which he calculated the financial state of the company. While he estimated that FTX could likely scrounge up $3.9 billion worth of assets over the course of a week, he wrote that there would still be a shortfall of $8.1 billion in terms of deliverable customer assets.

Neither Bankman-Fried nor his lawyer addressed the Google Doc or the message thread in court. Instead, Bankman-Fried defended the original Tweet: “My view at the time was that the exchange was okay and that there was no hole in terms of assets.” He has maintained that the issue was about liquidity as opposed to solvency—as in that he had the funds, but not in a way that he could immediately pay out.

Meanwhile, his collaborators testified that FTX had previously given outsiders a misleading view of their finances. Former FTX engineering director Nishad Singh said that at the end of 2021, Bankman-Fried had asked him to create backdated financial statements in order to get the exchange’s yearly revenue over $1 billion. Bankman-Fried denied directing him to backdate documents, but admitted to signing his name to a related contract many months after the contract’s listed date. Bankman-Fried’s lawyer Cohen defended his actions in that instance in his closing argument, saying: “The fact that he signed an agreement that others prepared for him doesn't move the needle.”

Wang said that FTX lied to the public about the size of its insurance fund, which was designed to protect customers from absorbing losses. Wang alleged that the company used a random number generator to make the insurance fund appear to be bigger than it was, and then published that number on the FTX website.

Caroline Ellison warned Bankman-Fried that the company was in trouble months before it crashed.

Bankman-Fried has long maintained that FTX’s collapse came as a complete surprise to him. But former Alameda CEO Caroline Ellison presented several spreadsheets that she had shown to Bankman-Fried over 2021 and 2022, which showed the devastating impact that a crypto crash could have on the company, which she wrote was borrowing billions from FTX. Bankman-Fried appeared to agree: “Yup, and could also get worse,” he commented on the Google Doc.

In the Google Doc, Bankman-Fried asked Ellison how an additional $3 billion in investments might impact Alameda’s financial health. The answer from Ellison’s numbers was clearly bleak—but Bankman-Fried went ahead and started a $2 billion venture fund anyway.

Former executives attacked Bankman-Fried mercilessly.

The top executives of FTX and Alameda Research had once been a tight-knit unit. Bankman-Fried and Ellison dated on and off. Bankman-Fried was on a group chat with Wang and Nishad Singh titled “the fantastic three.” For several months, all four of them shared the $30 million penthouse apartment in the Bahamas.

But Ellison, Singh and Wang all testified against Bankman-Fried under cooperation agreements with the government, and did not hold back in their criticism of FTX or Bankman-Fried. Singh said that by time FTX was on the brink of collapse, he had become suicidal and was feeling extreme guilt about his role in the organization: “I knew that I was becoming party and participating in something heinously criminal.”

Ellison said of Bankman-Fried: “He directed me to commit these crimes.” Wang admitted that he knew the actions he took with the company were wrong and that customers had not agreed for FTX to spend their funds. He added that Bankman-Fried had “said publicly that we would not use customer funds like this.”

Two more secondary players of the drama, FTX software developer Adam Yedidia and general counsel Can Sun also weighed in. “FTX defrauded all of its customers,” Yedidia said outright. (Judge Kaplan told the jury to strike that allegation from their minds.) Sun said he was “shocked” upon learning the special privileges that Alameda had on the platform.

Bankman-Fried’s last remaining allies included his parents Barbara Fried and Joe Bankman, who showed up to the courthouse to support him every day. After Bankman-Fried’s first time on the stand, his father walked over to him to deliver a grin and a thumbs up.

Bankman-Fried allegedly oversaw a $100 million bribe to the Chinese government.

One moment of the trial that drew audible gasps was when Ellison alleged that Bankman-Fried directed Alameda employees to pay a bribe to Chinese government officials in order to unfreeze $1 billion it had stored on two Chinese crypto exchanges. Bankman-Fried has been charged with foreign bribery related to this alleged incident, although it will be litigated in a separate trial scheduled for next year.

Ellison said that Alameda tried several methods of rescuing the money, including setting up trading accounts in the names of “Thai prostitutes.” After those attempts were unsuccessful, Ellison alleged that Bankman-Fried resorted to bribery—and that then she refused to write about the event directly in internal documents, instead labeling it “the thing.”

FTX’s political influence campaign was highly calculated and robust.

Bankman-Fried wasn't tried for political finance violations: that charge is also part of next year’s trial. But prosecutors still presented evidence of Bankman-Fried’s attempts to curry favor with regulators and policymakers. They presented a text message from Ryan Salame, an FTX executive who was heavily involved with Bankman-Fried’s political efforts that described their strategy of surreptitiously donating to candidates of both parties: “Sam wants to donate to both [Democratic] and Republican candidates in the US but cause the worlds frankly lost its mind if you [donate] to a democrat no republicans will speak to you…We will be heavily putting money to weed out anti crypto dems for pro crypto dems and anti crypto repubs for pro crypto repubs.”

Singh testified how he reluctantly became the conduit for Bankman-Fried’s political donations to Democratic candidates. Singh alleged that Salame had access to Singh’s Prime Trust bank account and would use it to make millions of dollars of donations in his name, all of which flowed first from FTX customers. Singh himself was barely involved in that decision making, he claimed: "After some point in time, my role was to click a button," he said.

Bankman-Fried cultivated an image of himself

When Bankman-Fried rose to fame in 2021 and 2022, he charmed many people in part thanks to his lack of pretense. Bankman-Fried almost always wore cargo shorts and an FTX t-shirt and rarely cut famously unkempt hair—even when onstage with former world leaders Bill Clinton and Tony Blair.

Ellison contended that this was an act. She testified that Bankman-Fried said his hair “was an important part of FTX's narrative and image.” She said that he opted not to drive the luxury car given to him by FTX because “it was better for his image to be driving a Toyota Corolla.”

Bankman-Fried denied these characterizations on the stand. He said that he wore a tee and shorts because they were “comfortable,” and that he didn’t cut his hair because he was “kind of busy and lazy.”

His friends said he had a mean streak.

Part of Bankman-Fried’s public image was his affable, earnest demeanor. But during testimony, his closest colleagues attempted to puncture this impression. Ellison told stories of Bankman-Fried angrily confronting her and blaming her for Alameda’s troubles, reducing her to tears.

Singh described in vivid detail a confrontation he had with Bankman-Fried in the fall of 2022, saying: “Sam has some physical tells for when he is thinking hard or is upset. He puffed out his chest…closing his eyes, grinding his teeth or tongue in his mouth. When he opened them to respond, he would sort of glare at me with some intensity.”

When Bankman-Fried took the stand and was questioned by his own lawyer Cohen, he appeared relaxed and jovial. He was much more tense and even petulant when being cross-examined by prosecutor Danielle Sassoon. When confronted with tough questions, Bankman-Fried swayed side to side, furrowed his brow, and scratched his face.

More Must-Reads from TIME

- Breaking Down the 2024 Election Calendar

- Heman Bekele Is TIME’s 2024 Kid of the Year

- The Reintroduction of Kamala Harris

- What a $129 Frying Pan Says About America’s Eating Habits

- A Battle Over Fertility Law in China

- The 1 Heart-Health Habit You Should Start When You’re Young

- Cuddling Might Help You Get Better Sleep

- The 50 Best Romance Novels to Read Right Now

Contact us at [email protected]

An FTX co-founder and the former CEO at Alameda Research plead guilty to fraud

Two of Sam Bankman-Fried's top business partners — a co-founder of the cryptocurrency exchange FTX and the former CEO of the hedge fund Alameda Research — have pleaded guilty to fraud, a federal prosecutor in New York said Wednesday.

Former Alameda CEO Caroline Ellison and FTX co-founder Gary Wang are cooperating with prosecutors, the U.S. attorney for Southern New York said in a video statement.

Ellison and Wang were charged “in connection with their roles in the frauds that contributed to FTX’s collapse,” U.S. Attorney Damian Williams said.

A plea agreement for the criminal charges shows seven counts for Ellison, including wire fraud and conspiracy to commit securities fraud and money laundering. In Wang’s case, the plea agreement list four charges, including wire fraud and conspiracy counts.

Ilan Graff, an attorney for Wang, said in an email Wednesday: “Gary has accepted responsibility for his actions and takes seriously his obligations as a cooperating witness.”

Attorneys for Ellison did not immediately respond to a request for comment.

Civil fraud charges

On Wednesday, the Securities and Exchange Commission announced civil fraud charges against Ellison and Wang "for their roles in a multiyear scheme to defraud equity investors in FTX."

They also face fraud charges from the Commodity Futures Trading Commission .

The SEC complaint alleges that Wang "created FTX’s software code that allowed Alameda to divert FTX customer funds" and that Ellison used those funds for Alameda's trading.

It also alleges that Ellison and Wang worked with Bankman-Fried to move hundreds of millions of dollars of FTX customer funds to Alameda after they realized the companies didn't have enough assets to pay back customers.

The SEC alleged in its complaint that since around FTX’s founding in May 2019, some customer funds went immediately into Alameda accounts.

“Billions of dollars of FTX customer funds were so deposited into Alameda-controlled bank accounts,” the complaint reads.

The SEC said it had agreed to settlements with Wang and Ellison, which are subject to court approval.

Downfall of FTX

The barrage of criminal and civil charges against the two top executives has revealed new details about the downfall of FTX, including how customer assets freely moved from the crypto platform to Alameda, the privately held hedge fund Bankman-Fried co-founded.

Bankman-Fried, 30, a co-founder and the former CEO of FTX, is accused of misappropriating billions of dollars deposited into the huge cryptocurrency exchange, which collapsed last month .

Prosecutors have said it was a yearslong fraud that involved funneling money into Bankman-Fried’s private hedge fund.

Customers are estimated to have lost more than $8 billion, the acting director of the CFTC’s Enforcement Division has said.

Williams, the U.S. attorney, has said Bankman-Fried also made “tens of millions of dollars in illegal campaign contributions” to candidates and committees associated with both Republicans and Democrats.

He has been indicted on eight counts, including wire fraud, conspiracy, money laundering and violating campaign finance laws.

The SEC complaint alleges that fraudulent activity began early on.

“From the inception of FTX, Defendants and Bankman-Fried diverted FTX customer funds to Alameda, and continued to do so until FTX’s collapse in November 2022,” the SEC complaint says.

The SEC also alleges a complex scheme to trick both investors and customers into believing FTX had strict and advance risk mitigation.

“In truth, Bankman-Fried and Wang, with Ellison’s knowledge and consent, had exempted Alameda from the risk mitigation measures and had provided Alameda with significant special treatment on the FTX platform, including a virtually unlimited ‘line of credit’ funded by the platform’s customers,” the SEC wrote in its complaint.

And while the complaint details Wang and Ellison’s involvement in the company’s alleged wrongdoing, “Bankman-Fried remained the ultimate decision-maker at Alameda” and FTX, the SEC complaint reads.

The CFTC complaint separately details allegations that Bankman-Fried hid trading liabilities from Alameda in a customer account on FTX "that Bankman-Fried would later refer to as 'our Korean friend’s account' and/or 'the weird Korean account.'"

"As a result, it was no longer apparent on FTX’s ledgers that Alameda had an $8 billion negative balance on its FTX account," the complaint reads.

At one time, FTX was reportedly valued at $32 billion and seen as the face of the industry. The MIT-educated Bankman-Fried had been hailed as a kind of crypto genius.

Williams, the U.S. attorney, said in Wednesday night’s announcement that Bankman-Fried was in FBI custody and was being transported to the U.S. from the Bahamas, where he was arrested Dec. 12.

He agreed this week to be extradited and landed late Wednesday in Westchester County Airport in White Plains, New York, NBC New York reported.

Williams said Wednesday that the investigation is not over.

“If you participated in misconduct at FTX or Alameda, now is the time to get ahead of it,” he said. “We are moving quickly, and our patience is not eternal.”

Phil Helsel is a reporter for NBC News.

Jason Abbruzzese is the assistant managing editor of tech and science for NBC News Digital.

Ezra Kaplan is a producer for NBC News.

FTX’s implosion and SBF’s arrest, explained

Sam Bankman-Fried and his crypto company FTX experienced a shocking downfall. Now, Bankman-Fried has been arrested in the Bahamas.

by Emily Stewart

Sam Bankman-Fried , one of the crypto industry’s biggest stars, has had a rough end to 2022 . His crypto exchange FTX — which was once valued at $32 billion — declared bankruptcy in November, leaving his customers unable to withdraw their money and his investors out of luck. Now he’s been arrested in the Bahamas following the filing of criminal charges in the US, where he remains in jail after being denied bail and awaits an extradition hearing on February 8, 2023. The charges include wire fraud, securities fraud, money laundering, and campaign finance laws violations. The Securities and Exchange Commission has charged Bankman-Fried with defrauding equity investors, and the Commodity Futures Trading Commission has filed a complaint against him as well.

Before the scandal, Bankman-Fried captured the interest of those in finance, politics, philanthropy, and beyond. He said he might spend as much as $1 billion on the 2024 election. He said he had a lot of ideas for policing the crypto industry and using his crypto-fueled fortune for good . He said he’d be fine bailing out some crypto companies in trouble as crypto winter hit over the summer. All of these claims are now essentially meaningless, thanks to another thing he said on November 7: that his crypto exchange, FTX, was “fine.” It was not. Instead, the next day, the exchange imploded. By November 11, the company had filed for bankruptcy , and Bankman-Fried resigned as CEO.

The company’s balance sheet has since been revealed to be a disaster , and it’s unclear where much of the company’s money has even gone. FTX’s new CEO — who helped manage Enron after its 2001 collapse — said that he has never in his career “seen such a complete failure of corporate controls and such complete absence of trustworthy financial information.” He believes FTX collapsed because a “very small group of grossly inexperienced and unsophisticated individuals” running the company “failed to implement virtually any of the systems or controls” needed to handle other people’s money. The situation, again, coming from the guy who dealt with the Enron fallout, is “unprecedented.”

“It’s incredible how quickly these things can spiral out of control,” Molly White, a software engineer and prominent crypto critic behind the website Web3 Is Going Just Great , told me in a November interview in the wake of FTX’s collapse.

Whether or not you’re a crypto person , chances are you’ve come into some sort of contact with FTX and its founder, Sam Bankman-Fried — better known as SBF — before its implosion. He’s partnered with big names, such as soon-to-be-divorced couple Tom Brady and Gisele Bündchen , to spread the crypto gospel. He co-hosted Crypto Bahamas with medium name Anthony Scaramucci; figures such as Bill Clinton and Tony Blair attended. (Disclosure: This August, Bankman-Fried’s philanthropic family foundation, Building a Stronger Future, awarded Vox’s Future Perfect a grant for a 2023 reporting project. That project is now on pause.)

FTX ran a memorable ad featuring Larry David during the Super Bowl encouraging people to jump into crypto, even if they didn’t really get it. He bought the naming rights to the Miami Heat’s arena; if that name will soon have to change is uncertain . Bankman-Fried was a major donor to Joe Biden’s presidential campaign and again in the 2022 midterms, largely in the primaries. He slowed political spending down in the election cycle’s final weeks. He had positioned himself as the “acceptable” face of crypto to Washington, DC, policymakers, and the public.

Sign up for The Big Squeeze newsletter

Emily Stewart’s column exposes the ways we’re all being squeezed under capitalism. Sign up here.

In a matter of days in the fall of 2022, his empire exploded in a rather spectacular fashion. Thanks to a leak about the financial health of a trading firm he founded, Alameda Research, and some savvy maneuvers from a competing exchange, Binance, investors began to pull their money out of FTX en masse. FTT, a token the company issues, plunged in value. FTX was forced to seek a bailout. It didn’t get one. Now, much of the operation has been revealed to be a house of cards, and Bankman-Fried is facing serious charges.

Billions of dollars have been wiped from Bankman-Fried’s net worth, who now says his wealth is in the tens of thousands of dollars; FTX is bankrupt. The picture emerging is an ugly one. FTX could have 1 million creditors affected by its bankruptcy proceedings, and it’s not evident when, if ever, its customers will see any of their money returned.

John J. Ray III, the aforementioned new CEO of FTX, said in a statement on November 11 that Chapter 11 is “appropriate to provide FTX Group the opportunity to assess its situation and develop a process to maximize recoveries for stakeholders.” Bankman-Fried, who has said he’s intent on finding ways to help customers who can’t get their money out of the exchange, was to remain on in the transition, though the company has sought to distance itself from him. A tweet on November 16 says he has “no ongoing role” at FTX, FTX US, or Alameda, and he “does not speak on their behalf.”

This didn’t stop Bankman-Fried from giving interview after interview about FTX, among the most explosive of which was conducted by Vox reporter Kelsey Piper , until his December 12 arrest. During that conversation, among other things, he claimed regulators — who he was previously courting — “make everything worse,” acknowledged a lot of his talk about ethics was a front, and said “each individual decision” he made “seemed fine and I didn’t realize how big their sum was until the end.”

He also claimed he would have been able to make customers fully whole within a month had FTX not filed for bankruptcy (without offering up any explanation how) and seemed to be holding on to some sort of hope he would still be able to turn things around. “A month ago I was one of the world’s greatest fundraisers,” he wrote in the DM. “Now I’m the fallen wreckage of one but there’s a thing about being fallen — there are people who know what it’s like, and who want to do for someone else what nobody did for them.”

Despite Bankman-Fried’s borderline delusional beliefs about a turnaround, it’s hard to see this ending well. Some 130 entities, including FTX, FTX US, and Alameda Research, are involved in the bankruptcy proceedings. Bahamian authorities arrested Bankman-Fried after receiving notice that the US filed criminal charges against him. On Tuesday, December 13, a Bahamian judge denied Bankman-Fried’s attorneys’ request that he be released on $250,000 bail and said he must remain in jail there until his next hearing in February 2023. Bankman-Fried is poised to fight extradition to the US. (The Bahamas has an extradition treaty with the US.)

Bankman-Fried spent the weeks prior to his arrest peddling countless apologies on Twitter and in media interviews. “I’m piecing together all of the details, but I was shocked to see things unravel the way they did earlier this week,” he wrote in a series of tweets in November. The picture coming together of how his operations were run reveals the unraveling was perhaps not so shocking after all.

“Sam went from being the darling of the regulators to suddenly being a pariah, and it happened in a matter of what? Three days?”

Crypto has seen a series of blowups over the past decade, and this is among the biggest — the industry’s Bear Stearns moment , in a way.

“Sam went from being the darling of the regulators to suddenly being a pariah, and it happened in a matter of what? Three days?” said Douglas Borthwick, chief business officer at INX, a crypto trading platform. “Astounding.”

FTX’s shocking implosion, explained-ish

In some ways, the story of what happened here is a bit of a classic one — one competitor (Binance) saw the opportunity to try to kill off another (FTX), so it did.

“This is two crypto exchange founders doing economic warfare, and one clearly won and one clearly lost,” said David Hoffman, the co-owner of Bankless , a podcast and newsletter in the crypto space.

How it was able to do so is a little complicated to unpack.

Changpeng Zhao, a Chinese-born entrepreneur with Canadian citizenship who is more commonly referred to as CZ, launched Binance in 2017 and has since grown it to be the biggest crypto exchange in the world. Bankman-Fried launched Alameda Research, a quantitative trading firm focused on digital assets, in 2017, and then FTX, an exchange, in 2019. Bankman-Fried stepped away from running the day-to-day at Alameda, but the two entities remained very much connected .

Up until November, the story was that FTX and Alameda were in decent shape. FTX had a $32 billion valuation , its smaller FTX US division (that’s in line with US regulations and doesn’t allow nearly as much risky behavior as regular FTX does ) was pegged at $8 billion , and Alameda had brought in a $1 billion profit in a single year. Things have since fallen apart very fast.

On November 2, Ian Allison at CoinDesk published a leak revealing that much of Alameda’s $14.6 billion in assets were parked in a digital token created by FTX, called FTT. (In crypto, tokens are digital assets built on a blockchain.) Among other perks, FTT tokens give holders a discount on FTX trading fees. But the tokens were, like a lot of crypto tokens, kind of a made-up thing where their value was derived in believing there was value. “They printed this token out of thin air, endowed it with some valuation, and then Alameda used it as collateral,” said Nic Carter, partner at venture capital firm Castle Island Ventures.

Bloomberg’s Tracy Alloway used the example of a Beanie Baby you buy for $5 and then sell for $20 because you make a price guide saying that’s what he’s worth. In this case, FTX was making the Beanie Baby itself — as in issuing the FTT token for free — then buying some of the tokens back for whatever amount. It was then able to say the token was worth that amount and do business with it by, for example, using it as collateral for a loan.

The CoinDesk leak and revelations that it had so much money in FTT prompted questions about Alameda’s financial health and concerns that a fall in the token’s value could cause real problems for both the trading firm and FTX .

Days later, on November 6, Zhao said on Twitter that Binance would be liquidating its FTT holdings, which it received after exiting its stake in FTX last year. (Binance was an investor in FTX, with Zhao buying a 20 percent stake in the exchange soon after its launch, according to Reuters.) He said Binance received $2 billion in tokens, including some in the FTX token, at the time, but due to “recent revelations that have come to light,” they were offloading the FTT.

The whole thing sort of spiraled from there. Alameda’s CEO, Caroline Ellison, insisted Alameda was fine and offered to buy Binance’s FTT at $22 a token, around where it was at the time. (Ellison is an interesting character, and Forbes has a good profile of her here .) Bankman-Fried claimed FTX’s assets were fine. Investors didn’t believe them.

FTT’s value plunged and is now under $2, holders made a mad dash to sell, and customers started trying to pull their money out of FTX altogether. The exchange suffered from a liquidity crunch, meaning it ran out of money. By November 8, it became apparent that this was all sort of the “this is fine” meme, but the fire had engulfed the building and everyone in it. Bankman-Fried announced that FTX had reached a “strategic transaction” to hand FTX over to Binance (but not FTX US). Zhao said Binance had signed a non-binding letter of intent to buy FTX, pending due diligence. The non-binding part wound up being important as reports soon began to emerge that Binance might back out, which it eventually did.

“As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com,” Binance said in a series of tweets . “In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.”

In a November 8 letter to investors , which include SoftBank, Tiger Global, and the Ontario Teachers’ Pension Plan, Bankman-Fried said he was “sorry” he’d been hard to contact amid all the drama and that the “details are still being hashed out” in the Binance deal — a deal that he noted was non-binding and, ultimately, would soon be defunct. “Our first priority is to protect customers and the industry; that’s been guiding what we do,” he wrote.

On the morning of November 9, Zhao tweeted out a note he’d sent to the Binance team saying he “did not master plan this or anything related to it” and that he had “very little knowledge of the internal state of things at FTX” before Bankman-Fried called asking for help. (To be sure, his tweet earlier in the week indicated he had a hunch otherwise.) Semafor reported on November 8 that FTX had tried to get a bailout from Silicon Valley and Wall Street investors before resorting to Binance; many of FTX’s investors reportedly said they were blindsided by the deal .

“Clearly, something was very awry”

“Binance saw something at FTX, they realized there was a vulnerability — we don’t know what it was yet — and realized they could take them out, which they did. It was really an incredible strategic move,” Carter said. “For Sam to sell to his literally biggest competitor, it definitely is a tough pill to swallow, so clearly, something was very awry.”

This wasn’t the beginning of Zhao’s and Bankman-Fried’s simmering rivalry — the former didn’t love the latter’s policy outreach in the US — but it was the first time it had boiled over in such a big way. The potential deal signaled a detente, but now, it appears the hostilities remain. “At some point I might have more to say about a particular sparring partner, so to speak,” Bankman-Fried tweeted on November 10 in an apparent reference to Zhao. “But you know, glass houses. So for now, all I’ll say is: well played; you won.”

There are still some unknowns here, though the knowns are pretty wild

In a call with investors on November 9, first reported by the Wall Street Journal , Bankman-Fried told them he needed $8 billion to cover all of the requests customers were making to withdraw their money. Several of FTX’s investors have written down their investments in FTX to $0, meaning they think it’s worthless.

Since things began to fall apart in early November, there’s been quite a bit of speculation as to what happened. Many people I spoke with openly wondered where the original leak to CoinDesk had come from. Reuters reported on November 10 that Bankman-Fried had transferred at least $4 billion in funds to Alameda to prop the firm up after it had suffered losses, a portion of which were customer deposits. He reportedly didn’t tell other FTX executives about it because he was nervous it would leak.

In testimony to be delivered before the House Financial Services Committee on December 13, FTX’s new CEO said that customer assets from FTX were indeed commingled with assets from Alameda, and that Alameda used client funds to engage in trading that exposed customer funds to huge losses. He also said that FTX went on a $5 billion “spending binge” in late 2021 through 2022, and that loans and other payments over $1 billion were made to insiders.

To state the obvious here, none of this is good. When you give your money to a crypto exchange, you are supposed to be able to get it back when you want to. That means “a client fund needs to be segregated, whether that’s dollars or whether that’s crypto,” Borthwick said. And if the exchange isn’t holding onto the client funds but is instead lending them or trading them ( as Matt Levine at Bloomberg points out , banks, for example, lend customer deposits), then it runs the risk of not having the money to hand back to clients, especially when the clients come asking for the money all at once.

On November 12, the Financial Times published a copy of FTX’s balance sheet dated two days earlier that was, to put it plainly, bonkers. It revealed that much of FTX’s assets were in venture capital investments that weren’t liquid and crypto tokens that were, as FT noted, not widely traded and that, as Bloomberg’s Levine explained, were sort of “magic beans” that FTX had made up. The balance sheet also listed a negative $8 billion entry labeled “hidden, poorly internally labeled ‘@fiat’ account” and a $7 million holding called “TRUMPLOSE.”

Bankman-Fried keeps offering up explanations, though they are often caveated with the assertion that he’s still “ fleshing out every detail ” of what happened and that everything he’s saying is “ to my knowledge .”

“In a very real way, SBF did this to himself, and its impacts will be felt across the ecosystem even by those trying to make a real difference,” said Scott Moore, the co-founder of Gitcoin, a project for building and funding Web3 open-source infrastructure, referring to other projects in the space around areas like decentralized finance and public works.

FTX was not as transparent as it should have been about what it was doing with assets and deposits, and as the public and the authorities learn more, criminal activity may in fact be involved. “At some point, because of the situation with the FTT price [falling] and the information that Alameda had these positions that were collateralized with the FTT token and all of these things, it translated to a bank run on FTX,” said Alex Svanevik, CEO of blockchain analytics platform Nansen, referring to the colloquial term for when a critical mass of customers removes their money from a financial institution over solvency fears. “The great irony is that, of course, SBF was the guy who was in Washington trying to engage with regulators, and it looks like he didn’t have his own house in order.”

What happened is not entirely different from what transpired when crypto lender Celsius filed for bankruptcy earlier this year or when crypto broker Voyager or another crypto lender, BlockFi , went under.

“People park money with these different entities and then trust these entities with having control over the funds, and on the back end, these entities are doing frankly irresponsible things with customers’ deposits,” Svanevik said. It causes problems because crypto’s very volatile, so valuations can fluctuate quickly and make it riskier than more traditional assets.

FTX’s downfall has caused contagion across other players in the crypto industry , meaning one failure causes disruptions at other organizations . Troubled crypto lender BlockFi, which Bankman-Fried said he would bail out in June , filed for chapter 11 bankruptcy in late November as part of the FTX fallout. Multiple other companies are in trouble.

“The last several months, FTX was coming out as the savior of the industry and trying to help others,” said Reena Aggarwal, a professor of finance at Georgetown.

Zhao has perhaps taken Bankman-Fried’s place as the voice of crypto and the industry’s savior. He has said the sector “will be fine” and is trying to set up a recovery fund to help people in the arena. Still, as the Wall Street Journal notes, Binance’s financial situation is a mystery as well.

One point of relief is that FTX’s collapse and the current turmoil in the crypto industry has not affected the broader financial system. “If it was a regulated bank, the Fed would have stepped in, but it’s not,” Borthwick, whose own exchange runs entirely within the lines of US securities laws, said.

Whether this was a Bear Stearns situation, a Bernie Madoff scenario, a combination, or something else entirely, for customers holding money on the exchange, it doesn’t really matter what the mechanism was if they don’t get that money back, which it seems increasingly unlikely they will . Not to mention the investors who backed FTX and will very likely not be seeing a return on that investment and will lose most or all of their capital.

“It doesn’t matter what the scheme was on the back end if you can’t get your money out,” Svanevik said. “They exercised poor risk management and they jeopardized customers’ deposits, which they shouldn’t do.” Though, of course, it matters to US authorities.

The story has all sorts of twists and turns and open questions. The company apparently hired an in-house psychiatrist who talked to the New York Times about prescribing stimulants to employees. The Times and other outlets have also reported that many of the employees lived together and were romantically involved, including Bankman-Fried and Ellison. Some of the products Alameda was advertising — including high-yield loans with “no downside” — look sketchy as hell .

Crypto is still a roller coaster you might want to stay off of

FTX’s implosion has been nothing short of spectacular. While many people I spoke with noted they’d had some hesitation about FTX and Alameda intermingling in the past and potential conflicts of interest , most acknowledged they really did not expect this to happen this fast and in this way.

“[FTX] was so intent on legitimizing themselves and getting in the DC policy orbit,” Carter said.

Bankman-Fried’s power has evaporated and then some. He had really positioned himself as the face of crypto and certainly of FTX (the company literally ran ads featuring him). His regulatory and political investments, at least for the time being, are quite worthless, as is his weight in the crypto policy arena.

“The bill that Sam was working on is dead in the water, crypto loses some of its luster among these politicians that FTX was cozying up to,” Carter said. “There’s a renewed sense that this industry is just totally unregulated and run by crooks and fraudsters.”

“A situation like this becomes, frankly, quite embarrassing”

“A key pillar of FTX’s marketing strategy has been to elevate the personal brand of SBF, and that’s where a situation like this becomes, frankly, quite embarrassing,” Svanevik said.

Bloomberg estimates that Bankman-Fried’s personal wealth has been wiped out; his net worth had been pegged at nearly $16 billion at the start of November, and is believed to have peaked at $26 billion in March. He is a major player in philanthropy and, specifically, the effective altruism movement , where adherents — including some like Bankman-Fried who are or aim to become ultra-wealthy — give away money to try to do the most good for the most people. His plunging net worth means significantly fewer funds for the causes he cares about — including pandemic prevention — and the effective altruism community has acknowledged the potential impact. The movement is now undergoing a moment of reckoning of its own .

The entire episode draws attention to a consistent theme in crypto: It remains very much the Wild West. Even the best-known billionaire (who probably is a billionaire no longer) advancing this new technological and financial paradigm can wind up in a house-of-cards, smoke-and-mirrors scenario. Bankman-Fried’s “FTX is fine” declaration is reminiscent of a message another prominent crypto figure, Do Kwon, sent over the summer when his operation collapsed , telling his customers, “steady lads.”

“It’s remarkable, again and again, how crypto personalities like SBF will claim that everything is fine up until the very second they have to admit it isn’t,” White said. Much of crypto hinges on the belief that everything is fine and that coins and tokens have value ... unless and until that belief dissipates.

The prices of many cryptocurrencies have declined in the wake of the FTX revelations. Binance, which has come under regulatory scrutiny of its own, has highlighted its own “ commitment to transparency ” in an effort to shore up confidence it won’t wind up like FTX. The share prices of Coinbase and Robinhood have fallen . Even people in the crypto space who don’t particularly love Bankman-Fried — including Zhao — acknowledge FTX’s troubles are bad for the industry. “Do not view it as a ‘win for us,’” Zhao wrote in early November. “User confidence is severely shaken. Regulators will scrutinize exchanges even more.”

Every time there’s a blow-up like this, there are calls for greater scrutiny on the arena overall, but many regulators and policymakers remain behind the curve. It’s worth noting that up to now, a lot of them were listening to Bankman-Fried, too . ( I interviewed Bankman-Fried about meme investing and regulations in 2021, when he told me, “Some things are clearly legitimate and some things are clearly bullshit, and there’s also this long tail of things that are a little bit confusing.”)

“SBF was just spending a lot of time in DC schmoozing with lawmakers and giving recommendations on possible crypto regulation, acting as the ‘adult in the room’ and the liaison from the crypto industry,” White said. “If I was those legislators, I would be questioning a lot of his suggestions.”

“Everyone wants to go bankless until they get punched in the face, and after they get punched in the face they say, ‘Hold on, where are the regulators?’” Borthwick said. But, he noted, this saga is very much still unfolding. “This isn’t the end of it.”

Update, November 16: This story has been updated with additional information about the status of Future Perfect’s grant from the Building a Stronger Future foundation.

Update, December 13, 7 pm ET: This story, originally published on November 10, has been updated throughout multiple times, including most recently with news of Bankman-Fried’s arrest and details about the charges against him.

- Business & Finance

More in this stream

Most Popular

- Michelle Obama articulated something Democrats have been afraid to say

- Republicans ask the Supreme Court to disenfranchise thousands of swing state voters

- The major political transformation flying under the radar at the DNC

- The massive Social Security number breach is actually a good thing

- The case of the nearly 7,000 missing pancreases

Today, Explained

Understand the world with a daily explainer plus the most compelling stories of the day.

This is the title for the native ad

More in Money

From shipping lanes to airspace to undersea cables, globalization is under physical attack.

Why, and how, the US should fix its debt problem.

It is important to hang onto grudges against the Supreme Court.

Is the Federal Reserve finally about to cut interest rates?

It’s the latest way Biden is trying to combat pesky “junk fees” driving up prices.

Elon Musk’s social media site is accusing brands of breaking antitrust laws.

What is Alameda Research? Sam Bankman-Fried’s secretive proprietary trading firm is major DeFi investor

By Daniela Ešnerová

Edited by Charlie Mellor

10:10, 29 December 2022 Updated

Quantitative cryptocurrency trading firm Alameda Research has been identified by Sam Bankman-Fried, the business’s founder, as the funding source behind the purchase of $546m of stock in Robinhood Markets (HOOD).

According to documents filed by Bankman-Fried with the Eastern Caribbean Supreme Court, he and Gary Wang, co-founder of the FTX crypto exchange with Bankman-Fried, borrowed $546m from Alameda.

This was used to capitalise a Bankman-Fried holding company, Emergent Fidelity Technologies, that acquired just over 56.2 million shares in HOOD .

The latest detail shines further light on the business activities of Alameda, which along with FTX and 134 other corporate entities, filed for Chapter 11 voluntary bankruptcy on 11 November 2022.

What is your sentiment on HOOD?

Market sentiment:.

Bullish Bearish

You voted bullish.

You voted bearish.

Give HOOD a try

Robinhood Markets (HOOD) share price

Major defi investor based in hong kong.

Alameda Research was founded by Bankman-Fried, known to the crypto world as SBF, in October 2017 and was a major decentralised finance ( DeFi ) investor. The Hong Kong-headquartered private equity firm has made more than 222 investments, according to Crunchbase .

The collapse of Alameda came after a leaked balance sheet revealed that the company’s books relied heavily on the FTX token ( FTT ) issued by the crypto exchange FTX.

On Monday 28 November, crypto lender BlockFi filed for bankruptcy . On the first day of its court hearing, it was revealed by attorney Joshua Sussberg that Alameda Research and FTX owed BlockFi around $1bn – approximately $671m on a defaulted loan to Alameda, and more than $355m in frozen funds on the FTX exchange.

On 2 December 2022, the Financial Times reported that Alameda stepped in for FTX last year to the tune of $1bn, after a customer incident on the platform – further evidence of how the companies did not act separately.

FTX token (FTT) to US dollar

Crypto empire melted.

Alameda’s relationship with SBF’s crypto exchange FTX has been at the centre of scrutiny after CoinDesk published Alameda’s balance sheet, revealing that 40% of the company’s assets were denominated in the FTT token.

The revelation that Alameda largely depended on its sister firm’s token rather than fiat currency or third-party cryptocurrencies sparked large numbers of investors to flee FTX and FTT and the company was unable to keep up with client withdrawal requests.

Binance backed out of takeover after due diligence

Rival cryptocurrency platform Binance had originally agreed to help FTX with what it called a “liquidity crunch” and take over the embattled business. However, Binance later back-tracked on the non-binding deal.

| Long position overnight fee | -0.0616% |

| Short position overnight fee | 0.0137% |

| Overnight fee time | 21:00 (UTC) |

| Spread | 6.00 |

| Long position overnight fee | -0.0616% |

| Short position overnight fee | 0.0137% |

| Overnight fee time | 21:00 (UTC) |

| Spread | 2.2652 |

| Long position overnight fee | -0.0616% |

| Short position overnight fee | 0.0137% |

| Overnight fee time | 21:00 (UTC) |

| Spread | 0.0012872 |

| Long position overnight fee | -0.0616% |

| Short position overnight fee | 0.0137% |

| Overnight fee time | 21:00 (UTC) |

| Spread | 106.00 |

“As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX,” said Binance in a tweet on 9 November.

Two days later, FTX and Alameda filed for Chapter 11 voluntary bankruptcy in Delaware and FTX founder and CEO Sam Bankman-Fried resigned from his role. The filing document also revealed that FTX and Alameda’s liabilities each ranged between $10bn to $50bn.

Alameda’s DeFi investment

Alameda was a big DeFi investor. According to Crunchbase , the company made 222 investments in the five years of its existence.

These include several capital injections for firms working on DeFi solutions. On 8 November, fintech and software company Fordefi announced it had raised $18m for the launch of an institutional DeFi wallet from Alameda and other investors.

“DeFi transactions are much more complex than simple asset transfers, and that’s the key to DeFi’s exciting new opportunities,” Fordefi’s co-founder Dima Kogan commented .

Tokens of Alameda-backed DeFi projects stuck on FTX

But other Alameda DeFi investee projects have felt the pain of their backer’s troubles.

Following Alameda’s bankruptcy, DeFi projects Oxygen and Maps.me, which had received tens of millions of dollars from Alameda last year, now have more than 95% of their token supply stuck on the defunct FTX platform.

“Whilst FTX Group did not hold any equity in the MAPS or Oxygen businesses, it did hold a significant proportion of MAPS/Oxy tokens,” the projects said on 15 November 2022.

“It also acted as custodian for over 95% of the overall supply of our ecosystem tokens – both locked and unlocked.”

Markets in this article

Related topics

Rate this article

Rate this article:

Related reading

What did bankman-fried, ftx and alameda do wrong.

Alameda FTT holdings: Did SBF’s trading firm hold own token as collateral?

FTX price prediction: No hope of recovery, say pundits

Still looking for a broker you can trust?

Join the 640,000+ traders worldwide that chose to trade with Capital.com

Start trading on HOOD .

- Skip to main content

- Keyboard shortcuts for audio player

She's the star witness against Sam Bankman-Fried. Her testimony was explosive

Caroline Ellison leaves federal court in Manhattan after testifying during the trial of former FTX CEO Sam Bankman-Fried on Oct. 10. Ellison said Bankman-Fried was the main decision-maker and steered her to transfer funds from cryptocurrency exchange FTX to Alameda Research, a financial firm she headed. Michael M. Santiago/Getty Images hide caption

Caroline Ellison leaves federal court in Manhattan after testifying during the trial of former FTX CEO Sam Bankman-Fried on Oct. 10. Ellison said Bankman-Fried was the main decision-maker and steered her to transfer funds from cryptocurrency exchange FTX to Alameda Research, a financial firm she headed.

Caroline Ellison, the former girlfriend of Sam Bankman-Fried and a top executive in his cryptocurrency business empire, has long loomed as the U.S. government's star witness in the ongoing trial of the disgraced founder of FTX.

And over a day and a half of testimony in a federal court in Manhattan, she delivered.

FTX founder Sam Bankman-Fried's trial is about to start. Here's what you need to know

In testimony on Tuesday and Wednesday that got tearful at times, Ellison accused Bankman-Fried of being the mastermind behind a concerted effort to steal billions of dollars from customers, investors and lenders.

And as Bankman-Fried's former girlfriend, she had intimate knowledge of both the company and the former crypto celebrity who now faces seven criminal charges that could send him to prison for the rest of his life.

Here are five takeaways from Ellison's explosive testimony.

Painting Bankman-Fried as the mastermind

Prosecutors are trying to prove that Bankman-Fried engineered and orchestrated a massive fraud.

He is accused of misusing billions of dollars in FTX customer money by directing the funds to Alameda Research, an investment firm that Bankman-Fried founded before FTX and that Ellison eventually ran.

Although Bankman-Fried's lawyers are justifying the transfer of funds as legitimate loans, prosecutors are seeking to paint it as fraud, arguing FTX customer money was used to plug financial holes at Alameda, as well as to make speculative investments, and to finance Bankman-Fried's lavish lifestyle.

In her testimony, Ellison sought time and time again to portray Bankman-Fried as the decision-maker at the company that she says she only nominally ran.

Ellison described Bankman-Fried as being "the one who set up the systems that allowed Alameda to take the money, and he was the one who directed us to take customer money to repay our loans."

Though Ellison was Alameda Research's CEO, she described her role as frustrating. She didn't get a raise when she was promoted, she said, and Bankman-Fried continued to make key decisions even after he left Alameda formally to focus on FTX.

"I handled a lot of day-to-day decisions and responsibilities in Alameda," she testified. "But for any major decisions, I would always run them by Sam, and I would always defer to Sam if he thought that we should do something."

When the prosecution asked her to explain why she was so deferential, Ellison noted there was always a difficult power dynamic between her and Bankman-Fried.

"I would say the whole time that we were dating, he was also my boss at work, which created some awkward situations," she said.

Describing Bankman-Fried's willingness to gamble

In her testimony, Ellison also painted Bankman-Fried as willing to take an extraordinary amount of risk with FTX's funds.

Ellison recalled Bankman-Fried's affection for games of chance and his tolerance for risk. For example, she remembered how he once talked about being willing to lose $10 million if he drew tails in a coin flip — as long as he had the chance to win more than $10 million if he drew heads.

Bankman-Fried took that same approach to running his businesses, Ellison said.

She described how, in 2021, Bankman-Fried wanted Alameda to spend $3 billion on a series of speculative investments in startup companies. She was charged with modeling how an investment of that size could affect Alameda's balance sheet.

Ellison arrives at federal court in Manhattan on Oct. 11 for the second day of testimony in the trial of Bankman-Fried. Ellison described desperate attempts to plug financial holes at Alameda Research. Spencer Platt/Getty Images hide caption

Ellison arrives at federal court in Manhattan on Oct. 11 for the second day of testimony in the trial of Bankman-Fried. Ellison described desperate attempts to plug financial holes at Alameda Research.

Ellison found that the $3 billion investment, as conceived, "would put Alameda in a significantly riskier position and make it much less likely or almost impossible that we would be able to pay off our loans if all of our loans were called at once."

Ellison presented those results to Bankman-Fried and suggested that the proposed investment would be too risky given the state of Alameda's finances. But Ellison said Bankman-Fried ordered her to go through with it.

Manipulating balance sheets

Ellison described Alameda's financial position as increasingly precarious as 2022 unfolded.

She was stressed, Ellison said, and detailed how she conferred with Bankman-Fried about the balance sheet at Alameda, noting growing problems with the company's ability to pay back loans.

"This was a time of crisis for Alameda," Ellison told the court.

It was during this time, Ellison said, that she and Bankman-Fried began to take even more money from FTX customers to pay back Alameda's loans. It was, she said, "the only option on the table."

In 2022, by late summer, Alameda had funneled more than $14 billion from FTX customers — all without their knowledge or consent.

"We were in a bad situation," she said.

At several times during her testimony, Ellison said Bankman-Fried directed her to manipulate spreadsheets to make Alameda's financial picture look more favorable and to ignore requests from lenders for additional information.

Over and over again, she said she did what Bankman-Fried asked her to do.

According to Ellison, when an executive at Genesis — which had provided Alameda with hundreds of millions of dollars in loans — asked for an updated balance sheet, Bankman-Fried "suggested I should find some alternate ways to present the information."

So Ellison created seven options, and she said Bankman-Fried advised her to send a version that minimized the size of Alameda's debts, while playing up the worth of the firm's holdings of FTT, a cryptocurrency that Bankman-Fried created.

Bankman-Fried arrives for a bail hearing at federal court in Manhattan on Aug. 11. The former FTX CEO faces seven criminal charges in an ongoing trial. If convicted, he could face the rest of his life in prison. Michael M. Santiago/Getty Images hide caption

Bankman-Fried arrives for a bail hearing at federal court in Manhattan on Aug. 11. The former FTX CEO faces seven criminal charges in an ongoing trial. If convicted, he could face the rest of his life in prison.

Ellison also said she disguised nearly $5 billion in personal loans that Bankman-Fried and several deputies received.

As a downturn in the cryptocurrency market deepened in 2022, Alameda's situation worsened.

As Bankman-Fried and his deputies worked behind the scenes to find ways to pay back billions of dollars in loans owed by Alameda, Bankman-Fried was making public pronouncements that were at odds with what was really happening. On social media, for example, he claimed his businesses were fine.

Trying desperately to raise funds

As panic grew among the top ranks of FTX, Bankman-Fried talked a lot about how he could raise more money from lenders and investors, Ellison testified.

She said Bankman-Fried talked repeatedly about trying to get money from Mohammed bin Salman, the crown prince of Saudi Arabia. The plan, as she detailed it, was to use money from Saudi Arabia to pay back Alameda's lenders. But that funding never materialized.

By the fall of 2022, Ellison said, she and other executives at the company were holding onto hope, however blindly, that they could secure additional financing from someone or that the price of cryptocurrencies would go up. That, she said, would lift up the value of the assets on Alameda's books.

"I was in a state of dread," she said.

Ultimately, however, FTX and Alameda collapsed, and in short order, FTX declared bankruptcy and Bankman-Fried was arrested. Days later, Ellison pleaded guilty to several criminal charges and agreed to cooperate with federal prosecutors in their case against Bankman-Fried.

Ellison's testimony also shed light on another incident that could land Bankman-Fried in more trouble.

In early 2021, a Chinese cryptocurrency exchange froze Alameda's trading account, and the firm lost access to approximately $1 billion in assets.

It's not just FTX's Sam Bankman-Fried. His parents also face legal trouble

For months, Bankman-Fried tried to regain access to those assets through a variety of methods. Ellison testified how colleagues at Alameda set up accounts on the Chinese exchange tied to the identities of Thai prostitutes, hoping they could somehow use those accounts to siphon the money away from the frozen account.

Ultimately, Ellison said, Alameda transferred $100 million in payments to what she understood to be Chinese government officials to unfreeze the account, which could constitute a bribe.

Ellison described a meeting in which a colleague whose father worked for the Chinese government protested repeatedly. Ellison said Bankman-Fried screamed at the employee to "shut the f*** up."

Judge Lewis Kaplan, who's presiding over the trial, allowed the use of that testimony "for limited purposes" — to demonstrate "the trust and confidence" that Ellison and Bankman-Fried had in each other.

But Kaplan also made clear to jurors that an allegation of bribing a foreign official is not one of the charges in this trial. But at a separate trial, expected to take place next year, Bankman-Fried will face charges of bribery and bank fraud.

Why Ellison's testimony matters

Though other former top executives at FTX businesses are testifying during the trial, Ellison was always considered the most important witness.

After prosecutors first called her to the witness stand, everyone stood and faced the two wooden doors at the back of Kaplan's courtroom. Moments later, Ellison was led down the center aisle to the witness stand.

When the prosecution asked Ellison whether she could identify Bankman-Fried for the jury, Ellison stood, squinted and scanned the room. It took almost a minute for her to locate him.

It has been almost a year since Ellison pleaded guilty to several criminal charges, including counts of fraud and conspiracy, and agreed to cooperate with the U.S. government in its multicount case against Bankman-Fried.

She is hoping for leniency in exchange, when she is sentenced after this trial ends.

The daughter of Massachusetts Institute of Technology economists, Ellison was a math major at Stanford University, and in her testimony, she described how she and Bankman-Fried met at the trading firm Jane Street. She was an intern, and he was a trader.

Before long, the defendant started his own crypto-focused investment firm, called Alameda Research, and Bankman-Fried convinced Ellison to join its ranks. But their relationship wasn't strictly personal.

In 2018, she and Bankman-Fried "started sleeping together on and off," Ellison told the court. And "in the summer of 2020, we eventually started a romantic relationship."

Over the course of hours of testimony, she described in detail personal and professional ups and downs, as well as the conspiracy that she has admitted to being an integral part of.

"When you were working at Alameda, did you commit any crimes?" the prosecution asked Ellison.

"Yes," she said. "We did."

- financial fraud

- cryptocurrency

- Sam Bankman-Fried

- Caroline Ellison

Exclusive: Sam Bankman-Fried Knew Plenty About His Alameda Research Hedge Fund–And Sent Details To Forbes Just Months Ago

- Share to Facebook

- Share to Twitter

- Share to Linkedin

W ith customers, investors and, potentially, law enforcement closing in, the fate of crypto wunderkind-turned-pariah Sam Bankman-Fried may rest on two key questions: What did he know about Alameda Research, and when did he know it?

Since the stunning, early November collapse of both Alameda, a secretive crypto hedge fund Bankman-Fried cofounded in 2017, and FTX, a crypto exchange he cofounded in 2019 and grew into one of the world’s largest, speculation has run rampant about how the two operations were intertwined and what chain of events drove both businesses into bankruptcy.

Bankman-Fried, in a series of high-profile media appearances this week, has begun offering his own working theory: Alameda took on far too much leverage to make risky investments on the FTX platform, and FTX failed to recognize and prevent it. A key claim: that Bankman-Fried himself didn’t really know what Alameda was up to.

“I was frankly surprised by how big Alameda’s position was,” Bankman-Fried said at The New York Times ’ DealBook Summit on Wednesday. “Alameda is not, like, a company that I monitor day-to-day,” he claimed to New York magazine in an article published Thursday . “It’s not a company I run. It’s not a company I have run for the last couple years. And Alameda’s finances I was not deeply aware of. I was only surface-level aware of Alameda’s finances.”

Just how “surface-level” remains to be uncovered, as a bankruptcy team picks through the wreckage to retrace what occurred. But a look inside Bankman-Fried’s discussions with Forbes provides an early baseline of Bankman-Fried’s awareness of Alameda’s dealings: Since January 2021, Bankman-Fried has sent Forbes details of some of Alameda’s major holdings at least five times in response to questions about his net worth, including explaining the specifics of certain transactions and updating the number of FTT, Solana and Serum tokens Alameda held–as recently as late August.

M ost of the world’s billionaires would rather not discuss their wealth. Not Bankman-Fried, who Forbes first approached about the subject in January 2021. “[H]appy to give an outline,” he wrote in an email. Later that week, he sent a handful of documents showing his ownership stakes in FTX (around half) and Alameda (90%), screenshots of wallets that held cryptocurrencies–and a Google Sheet listing his assets line-by-line, including details of his FTX equity plus holdings of 67.8 million Solana tokens, 193.2 million FTT tokens and 3 billion tokens of Serum.

Two months later, when Forbes was updating estimates for our annual World’s Billionaires list, Bankman-Fried updated the spreadsheet. Crypto prices were on the rise, plus Alameda had upped its share of FTT tokens, to 195.8 million. “Alameda funds under management, approx.” reads one line: $32,534,779,809. A separate column, listing only tokens that were unlocked–meaning able to be transacted–pegs Alameda’s total funds at a more modest $14.7 billion.

Updates like this arrived periodically–practically whenever Forbes asked for them. In September 2021, Bankman-Fried added a new tab to the Google Sheet. Alameda’s funds under management had grown to $37.6 billion, $16.8 billion counting only unlocked tokens. The business had made some Solana trades, he explained, and the number of FTT tokens on his balance sheet had also shifted. Bankman-Fried was well versed in the details: “[W]e used ~20mm FTT tokens as part of the funds to purchase back FTX equity from Binance (causing the decrease), and then subsequently repurchased that FTT in the market,” he wrote to Forbes . “So, as of now (a bit different from a few weeks ago!), we're back up to 186,442,198 unlocked FTT (after having sold off a bit on the recent rally).”

September 2021: With crypto markets riding high, Bankman-Fried created this Google Sheet for Forbes, pegging his net worth at $26.3 billion, including $17 billion in wealth tied up in Alameda. We estimated his fortune to be $22.5 billion around then.

In March 2022, Bankman-Fried updated the spreadsheet again with more specifics about his share of what Alameda owned. FTT holdings were down to 176 million tokens; Solana was down to 53 million. In late August, about a month before Bankman-Fried’s empire began to crumble, he again walked Forbes through his net worth, providing a capitalization table of FTX and FTX U.S.’ biggest shareholders . A new tab in the Google Sheet showed Alameda’s holdings too, with its investments in Solana, Serum and FTT unchanged at 53 million, 3 billion and 176 million, respectively. The total value of his share of Alameda’s funds under management, per Bankman-Fried at the time: $8.6 billion, or $6.4 billion counting only unlocked tokens. By then, there was much more going on below the surface, with Alameda likely in deep trouble, suffering from trading losses on highly-leveraged bets.

August 2022: Just a month before his empire crashed, Bankman-Fried created this Google Sheet for Forbes. He marked his own wealth at $26.5 billion. Forbes went with $17.2 billion.

T he level of detail Bankman-Fried provided to Forbes over the years shows that he had detailed knowledge of some of Alameda’s holdings and at least some knowledge of the transactions it was making, especially in 2021, despite stepping back from running the hedge fund after cofounding FTX in 2019. Bankman-Fried long insisted the two businesses operated independently of one another, though he is a shareholder of both.

It remains unclear how involved he was in Alameda’s operations, and his conversations with Forbes don’t necessarily show that he was aware of all of the hedge fund’s activities–the snapshots he sent were clearly incomplete, listing only major holdings, and he explained only a few major transactions, such as token purchases in 2021. Bankman-Fried has said Alameda ran into trouble in recent months. He declined to comment for this story.

Forbes based much of its estimate of Bankman-Fried’s net worth, which peaked at $26.5 billion in late 2021 but now appears to be close to zero , on the value outside investors like Sequoia Capital and Singapore government fund Temasek ascribed to FTX and its U.S. operations. We applied sizable discounts to Bankman-Fried’s self-reported Alameda holdings. In August, Forbes pressed Bankman-Fried for more details on his assets and liabilities, including a breakdown of Alameda’s balance sheet–both its investments and any debts it owed. “[W]orking on it!” he wrote in an email, opening the possibility that he went digging into Alameda’s books at least as recently as late August, more than a month before he said this week he became aware of what the business was up to. “[W]ill see what I can get,” Bankman-Fried wrote later that day, “a bunch is spread between a ton of wallets…” He never sent any more details.

MORE FROM FORBES

- Editorial Standards

- Reprints & Permissions

Alameda Co-CEO Trabucco Steps Down From Crypto Trading Firm

- Firm has ties to distressed crypto lenders Voyager, Celsius

- Caroline Ellison becomes sole CEO of Alameda after departure

Sam Trabucco

Source: Alameda Research

Alameda Research Co-Chief Executive Officer Sam Trabucco is stepping down, saying he’s chosen “to prioritize other things” and that he couldn’t “continue to justify the time investment” of being an integral part of the crypto trading firm.

Caroline Ellison , the co-CEO, will lead the company and Trabucco will serve as an adviser, he announced in a series of tweets Wednesday. Alameda, the trading affiliate of FTX crypto exchange controlled by Sam Bankman-Fried , confirmed the changes. FTX is one of the world’s largest platforms for trading digital-assets.

Health | Europe offers clues for solving America’s…

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to print (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Reddit (Opens in new window)

Today's e-Edition

- Latest News

- Environment

- Transportation

Breaking News

Health | this year’s new covid shot has been approved by fda, health | europe offers clues for solving america’s maternal mortality crisis.

Jennie Joseph, back left, lead midwife and clinic director performs a check up on Husna Mixon with the help of her children Asar Lorient, left, 7 and Alonzo Scott Jr., 1, Wednesday, June 26, 2024, at the Commonsense Childbirth Center in Orlando, Fla. (AP Photo/John Raoux)

Jennie Joseph, lead midwife and clinic director at the Commonsense Childbirth clinic talks with clients and staff Wednesday, June 26, 2024, in Orlando, Fla. The midwives who run the program welcome vulnerable patients that other practices turn away, such as those who are uninsured or haven’t had prenatal care until late in pregnancy. (AP Photo/John Raoux)

Marie Jean Denis, left, is examined by Jennie Joseph, lead midwife and clinic director at the Commonsense Childbirth clinic Wednesday, June 26, 2024, in Orlando, Fla. (AP Photo/John Raoux)

Marie Jean Denis, left, hugs Jennie Joseph, right, lead midwife and clinic director as she leaves after her appointment at the Commonsense Childbirth clinic Wednesday, June 26, 2024, in Orlando, Fla. (AP Photo/John Raoux)

Jennie Joseph, back left, lead midwife and clinic director at the Commonsense Childbirth clinic talks with client Regine Baramore as husband Scott holds six-week-old daughter, Yahareice, Wednesday, June 26, 2024, in Orlando, Fla. (AP Photo/John Raoux)

Midwife Celena Brown of Commonsense Childbirth in Orlando, Fla., speaks with Kayleigh Sturrup during a pregnancy checkup on Tuesday, June 25, 2024, accompanied by Ezra Wagnac, the son of Sturrup’s cousin. Midwives at Commonsense Childbirth are striving to provide good, accessible care. Experts cite the nonprofit, started by an immigrant from the U.K., Jennie Joseph, as model for helping reduce maternal mortality. (AP Photo/Laura Ungar)