Budget Planning and Budgeting Lessons

Budgeting teaching budget lesson plans learning worksheet household family planning exercises classroom unit teacher resources activity free tutorial curriculum basics.

Lessons appropriate for: 1st 2nd 3rd 4th 5th 6th 7th 8th 9th 10th 11th 12th Graders.

First Grade - Second Grade - Third Grade - Fourth Grade - Fifth Grade - Sixth Grade - Seventh Grade - Eighth Grade - Ninth Grade - Tenth Grade - Eleventh Grade - Twelfth Grade - K12 - Middle School - High School Students - Adults - Special Education - Secondary Education - Teens - Teenagers - Kids - Children - Homeschool - Young People

Teaching Special Needs - Adult Education - Budgeting for Kids - Children - Young Adults

Our Budgeting section delivers an array of educational tools. Dive into our collection that comprises lesson plans, printable worksheets, instructive videos, detailed articles, and more. Our lesson plans and printable worksheets are crafted to guide educators in imparting knowledge about the principles of budgeting and the importance of financial planning. Tailored to fit various learning environments, these resources are adaptable for both group lessons and self-paced studies. Our instructive videos provide a vibrant approach to understanding budgeting, bringing to life the nuances of financial planning with compelling animations and lucid breakdowns of intricate topics. Meanwhile, our detailed articles delve into the finer points of budgeting, offering expert commentary and profound insights into managing personal finances effectively. Whether you're a visual learner, a reading enthusiast, or someone in search of structured lessons, the Budgeting section of Money Instructor is equipped with resources to ensure you grasp the essentials of financial planning and lead a financially sound life.

Lessons and worksheets, suggestions or need help.

Do you have a recommendation for an enhancement to this budgeting money lesson page, or do you have an idea for a new lesson? Then leave us a suggestion .

More Teaching Earning and Spending Money Worksheets and Lessons

To teach and learn money skills, personal finance, money management, business, careers, and life skills please go to the Money Instructor home page .

Teach and learn money skills, personal finance, money management, business, careers, real life skills, and more.... MoneyInstructor ®

- New Member Registration

- Teaching Lessons

© Copyright 2002-2024 Money Instructor® All Rights Reserved.

Budgeting Worksheet Grade 6

Are you looking for a fun and engaging way to teach your sixth-grade students about budgeting? Look no further! Our budgeting worksheet for grade 6 is designed to help students understand the importance of managing their finances while also developing essential math skills. With a variety of interactive activities and real-life scenarios, this worksheet will provide students with the tools they need to make informed financial decisions in the future. Let’s dive into how this budgeting worksheet can benefit your students and enhance their financial literacy.

7 Free Printable Budgeting Worksheets

In this blog post, we are excited to share 7 free printable budgeting worksheets that are perfect for Grade 6 students. These worksheets are designed to help young learners understand the importance of budgeting and money management in a fun and interactive way. From tracking expenses to setting savings goals, these worksheets cover various aspects of personal finance and are a great resource for parents and teachers looking to introduce financial literacy to their children or students. With colorful designs and easy-to-follow instructions, these budgeting worksheets are a valuable tool for teaching kids the basics of budgeting and setting them on the path to financial success.

christianpf.com

Budgeting Scenario Worksheets

Budgeting scenario worksheets are an essential tool for teaching sixth graders the importance of managing money and making responsible financial decisions. These worksheets provide practical, real-life scenarios that students can relate to, helping them understand the value of budgeting and planning for their future. By working through these scenarios, students can develop critical thinking skills and learn how to prioritize their spending, save for important goals, and avoid unnecessary debt. Budgeting worksheets also serve as a valuable resource for teachers, allowing them to engage students in interactive activities that promote financial literacy and responsible money management. With the help of these worksheets, sixth graders can gain the knowledge and skills they need to make informed financial decisions as they grow older.

www.twinkl.co.uk

First Class Free Household Budget Spreadsheet Php Download Xlsx

Looking for a free household budget spreadsheet to help you manage your finances? Look no further! Our first-class household budget spreadsheet is available for download in PHP format, and it comes in an easy-to-use XLSX file. This user-friendly tool is perfect for Grade 6 students who are learning about budgeting and financial management. With this spreadsheet, students can track their income, expenses, and savings, helping them develop important money management skills at an early age. Download our budgeting worksheet today and start teaching your Grade 6 students the importance of budgeting and financial responsibility.

meaningmethod26.gitlab.io

Budget Planner Sheet Printable

Looking for a budget planner sheet printable to help teach your 6th grader about money management? Look no further! Our printable budgeting worksheet is perfect for introducing kids to the concept of budgeting and tracking their expenses. With categories for income, savings, and spending, this easy-to-use sheet will help your child understand the importance of budgeting and how to prioritize their spending. It’s a great way to start building financial literacy at an early age. Download our budget planner sheet printable today and start teaching your child valuable money skills!

old.sermitsiaq.ag

Budget Worksheets

Budget worksheets are an essential tool for teaching sixth graders about financial literacy and responsible money management. These worksheets provide a hands-on way for students to track their income and expenses, set savings goals, and understand the importance of budgeting. By using budget worksheets, students can develop critical skills such as calculating expenses, prioritizing spending, and making informed financial decisions. Incorporating budget worksheets into the curriculum helps students build a strong foundation for managing their finances and sets them on the path to becoming financially savvy adults.

www.teacherspayteachers.com

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

12 Fun Budgeting Activities PDFs for Students (Kids & Teens)

By: Author Amanda L. Grossman

Posted on Last updated: May 8, 2024

- 4.2K shares

- Facebook 60

- Pinterest 4.1K

- Flipboard 0

Looking for fun budgeting activities PDFs? You'll love this collection of budgeting scenarios for high school students, and money management worksheets for students (PDFs).

Teaching students how to budget doesn't have to be a drag, especially if you do it through fun budgeting activities.

But, have you noticed how difficult it is to find GOOD, fun budgeting activities with PDFs?

After spending a few hours scouring the internet, searching for the best FREE options out there, I've now become aware of the problem.

Still, there are some good options you should know about (plus, I'm releasing my own – for free!).

Fun budgeting activities (with PDFs) and money management worksheets for students are two of the best ways to teach your kids and teens about money.

Article Content

Budgeting Scenarios for High School Students (PDFs to Print)

I'd like to start this list off with my own budgeting scenarios I created for high school students (parents, you can use these, too!).

This budgeting worksheet for students (pdf) was originally part of my Money Prodigy Online Summer Camp, but I'm carving it out for you to use, for free.

Here's how this works:

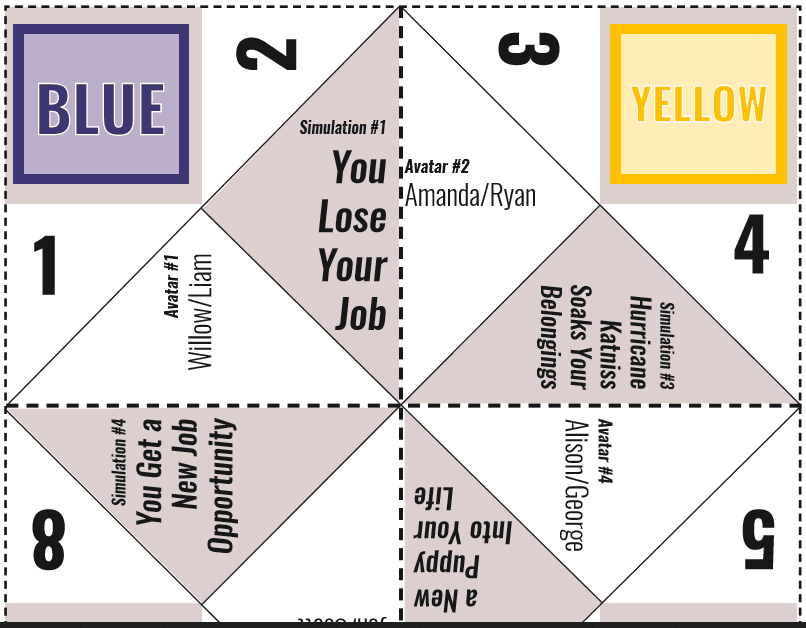

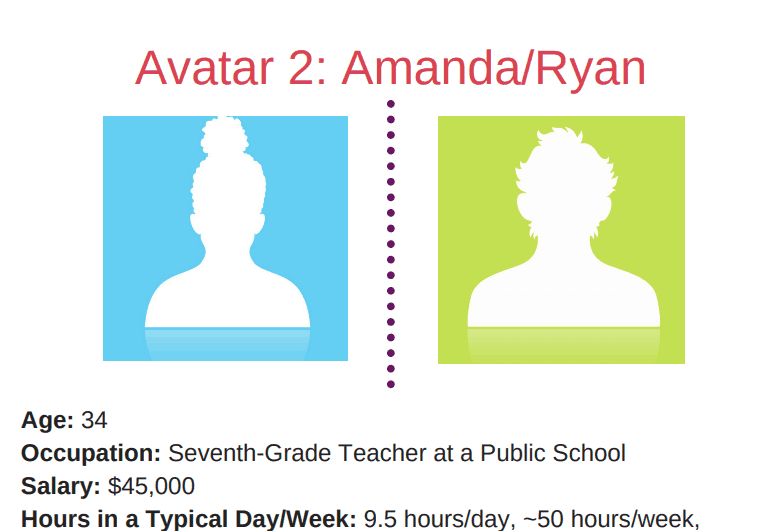

Your child uses a fortune teller (free printable) to determine which one of 4 Avatars they are. The avatars have both a female and a male name, but the information is the same — so it doesn't matter if a boy or a girl gets that avatar.

They read up on their salary information, budgeting information, and general financial information. Each avatar is at a different stage in their career, and in a different stage of life (so lots of possibilities to play several rounds of this).

They fill in a budgeting sheet based on the information they've been given.

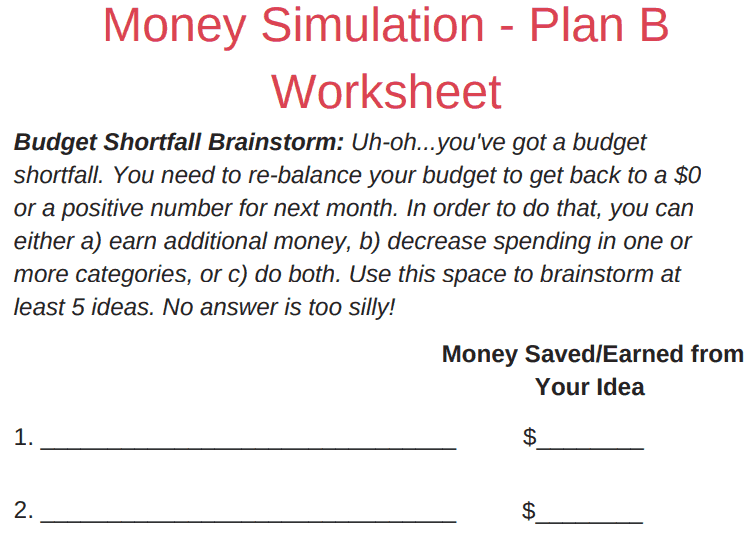

Then, the simulation really begins. They take a turn with the fortune teller again, who spits out a a real-life scenario. Once they figure out what their new situation is, they need to deal with it within their current budget constraints.

Your students then fill in follow-up questions and information about how things went for them.

Other resources for you:

- How to Teach Budgeting (from Beginner to Advanced Levels)

- 6 Budgeting Projects for Middle School Students

- 4 Budget Projects for High School Students

- 11 Teenage Budgeting Tips

- How a Teenager Can Improve their Budget

- Prom Budget Planner

Alright…let's move on to many more fun budgeting activities with PDFs and financial scenarios for students.

Fun Budgeting Activities (with PDFs)

Fun budgeting activities (PDFs you can print) will not only begin teaching your students and kids how to budget for specific events OR for life, in general, but it will make the process entertaining.

Heck, your kids might beg for more money activities after you introduce a few of these fun budgeting activities below.

Psst: you might want to check out my comprehensive article on budgeting for kids , and the best teen budget worksheets .

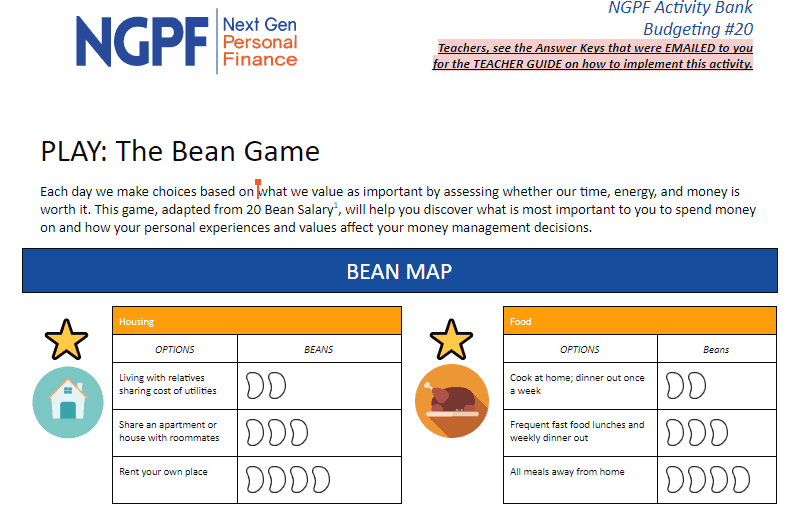

1. Next Gen Personal Finance’s Bean Game

Suggested Age Range: Not given.

I just love this – every student receives 20 beans, as well as a game board that shows a cost (in beans) for different spending and saving categories. Students must decide how to spend their 20 beans across all categories.

What might trip your students up? There are starred categories that are “musts”, so your student has to spend some beans on those.

Midway through, if you want to really shake things up, the creators of this game suggest telling your students that they’ve been demoted or downsized at work and now only have 13 beans – they must remove 7 beans from their boards.

This is an individual activity, but can easily be used in groups of 2 as well.

2. ConsumerFinance.gov’s Bouncing Ball Budgets

Suggested Age Range: 13-19 years

What I like about this spending activity is it has a physical component. Meaning, that kids get into a group and throw a ball at one another. The number that is closest to their right index finger (the ball has numbers on it) corresponds to a question about spending habits.

The student then has 30 seconds to answer the question, which will help them analyze their own spending habits.

Example questions include:

- Give an example of a big expense you’ve had to save money for.

- Give an example of why you might call yourself a saver or a spender.

- What do you find hard to resist spending money on?

3. Design Mom's Teen Budgeting Game

Suggested Age Range: For teenagers.

In just an hour of play, your students and teens can go through 12 months on a budget. New challenges are thrown their way for each month, such as being fined for a traffic ticket or earning an extra $5 in interest on savings.

Teens are given $300 each (remember, this is a game, not the real world!), and must satisfy 9 different budgeting categories ranging from rent to movies.

Free printables include:

- Budget Worksheet

- Banker’s Instructions

- Explanation of “Budget Options”

The goal of the game, or how to win? Is to end the game with $450 in savings PLUS a “Well Being” Factor of 96 or higher.

Psst: Here's more budget games for kids and teens to check out. Also, here's 19 free financial literacy games for high school students .

4. Jump$tart’s Reality Check Activity

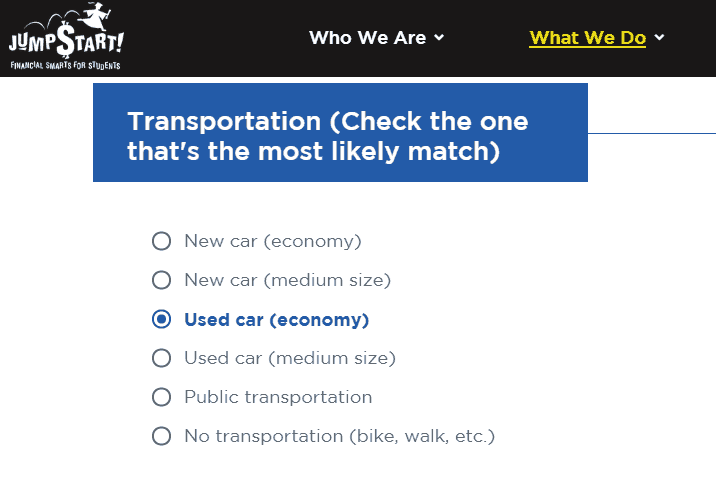

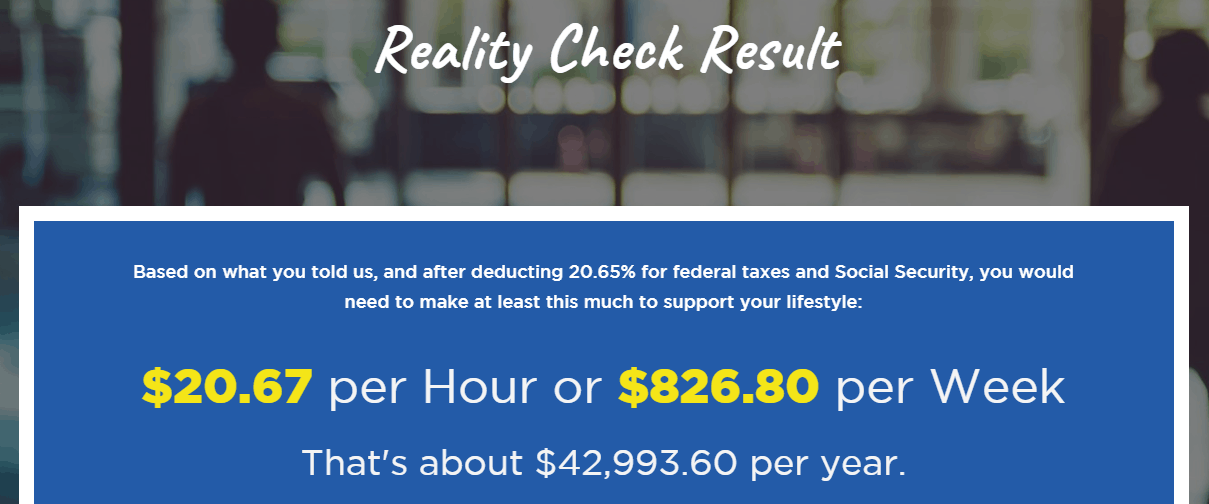

A fun activity to kick off money lessons or a money unit would be to have your students go through this Reality Check calculator.

They get to answer various questions (there are only 10) about the type of lifestyle they want to live, and then fill out estimated amounts they think they’ll spend each month for specific budget categories.

Then the “reality” kicks in when they see what kind of income they’ll have to maintain in order to live that lifestyle.

Suggestion: perhaps you can set this reality check game up on computers as a transition activity for students, OR, as one of your various money centers for the day.

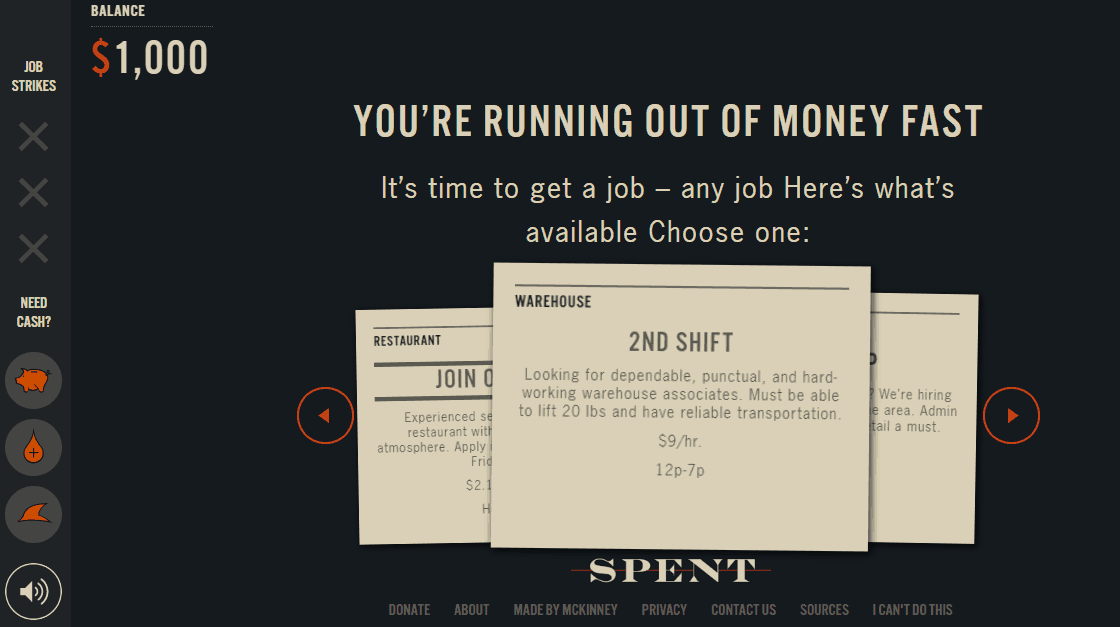

5. McKinney’s PlaySpent.org

Here’s an interesting budgeting game for students to play, that will also increase their awareness of how hard it can be to survive without a job.

They are given the scenario that they are down to their last $1,000 since losing their job. The object of this game is to use that $1,000 as wisely as possible so that they can live with it for over one month.

6. FinanceintheClassroom.org’s Investigation of Regional Housing Costs

Suggested Age Range: Grades 10-12

What I love about this budgeting scenario is that they actually created it – I’ve been talking about how important it is to research the cost of living before moving or accepting a job offer somewhere for years.

Mostly because I’ve had personal experience from it! In my mid-20s, I took a job in Palm Beach Gardens, Florida. While I learned a lot at the job (I was eventually laid off from it), the fact is, I didn’t save any money (outside of retirement) during those almost two years because the cost of living was just too high.

With this budgeting scenario, students are asked to look at the finances and situation of Trish and Scott who want to move from Annapolis, MD to somewhere else for a job offer.

Students then must analyze the housing costs for one of their new job offers and see if they can or cannot afford to accept the job and move there.

Such a valuable financial lesson to learn young (especially since because young adults are least able to afford high-cost-of-living areas).

7. Sarah and Jessica's Jelly Bean Game

Group students together in sizes of 2-4, and hand them 20 jelly beans in total (tell them not to eat them!). The group then collectively decides how they'd like to spend those 20 jelly beans, based on money values, spending needs vs. wants , etc.

For each round they go through, they'll deal with different scenarios, such as someone's leg breaking (did they choose to spend on insurance?), or getting a raise at work.

Now, let's move on to money management worksheets.

8. Budgeting a Trip in a Rural Setting Vs. City Setting

ConsumerFinance.gov has these two lesson plans that are exactly the same…except where the students plan a trip to: rural or a city location.

I say, why not take this a step further and show your students one aspect of cost-of-living by having them budget out BOTH a trip to a rural setting AND a trip to a city setting ?

Then, they can compare the costs of each and discuss why one is (most likely) costlier than the other.

Money Management Worksheets for Students (with PDFs)

I love that you're looking for money management worksheets for your students – it means you care about their money future!

After hours of research, I've curated a list of free printable money management worksheets (available in PDF format, so you can easily print them out), that, in my opinion, are the best available.

1. Practical Money Skill’s The Art of Budgeting

Suggested Age Range: 14-18 years

What I specifically like about this lesson is the “Rework a Budget” section, found on Page 11.

Students are given the chance to budget for a girl named Gabrielle. And then, they’re asked to rework the budget once her month actually played out – which is such a great lesson because, let’s face it, planned budgets and planned spending is often not what happens in real life.

Yet, you want to teach students to learn early on that just because your planned spending and your actual spending aren’t the same, doesn’t mean you should give up on budgeting.

Instead, rework it! They’ll get better and better with doing that, the more they budget.

2. Second Harvest Food Bank’s Shopping on a Budget Activity

I don’t know that I would call this budgeting activity fun , but eye-opening For sure.

This budgeting activity for students attempts to bring awareness to how difficult it can be to feed your family nutritious food on a low budget.

3. ConsumerFinance.gov’s Create a Savings First Aid Kit

One of the most valuable parts of this activity is having students complete the simple acts of:

- Brainstorming possible unexpected expenses that pop up in life

- Determine if those expenses are an emergency, or not

Simple, but effective.

I hope you've found some awesome fun budgeting activities, budgeting worksheets for students, and budget scenario activities you're going to give a try with your own students and kids. Let me know how it goes in the comments below!

- Latest Posts

Amanda L. Grossman

Latest posts by amanda l. grossman ( see all ).

- Free Printable Generic Vs. Brand Taste Test Activity - December 11, 2024

- 7 Christmas Classroom Party Games for Kids (from Dollar Tree) - November 22, 2024

- 100 Ways to Make Money as a Kid Under 13 (Besides a Lemonade Stand) - November 12, 2024

- 6th Grade Math

- Consumer math

6th Grade consumer math worksheets: Budgeting, Saving, and Spending

Do you want to help your 6 th graders learn how to manage money better and make smart financial decisions from now like budgeting, saving, and spending ? Your 6th graders might think that consumer math is too complicated or boring for them. Don’t worry! 6th Grade consumer math worksheets are here to simplify everything.

How to help your 6th grader master consumer math skills with fun and engaging worksheets

As we know, consumer math is more than just about numbers and formulas. It is also about real-life situations that affect families every day. Therefore, in collaboration with Mathskills4kids.com , this article will provide a vast collection of fun and engaging worksheets that will help your 6th grader master consumer math skills in no time.

Consumer math can help 6 th graders learn how to plan their budget, save for goals, shop wisely, pay their taxes and tips, and avoid common money mistakes. This article will discuss why consumer math is essential for 6th-grade students and how to use worksheets to reinforce it.

We will also provide examples of consumer math exercises your students can practice at home or in the classroom.

BROWSE THE WEBSITE

Download free worksheets, grade 6 math topics.

- Whole numbers

Multiplication

- Exponents and square roots

- Number theory

- Add & subtract decimals

- Multiply & divide decimals

- Fractions & mixed numbers

- Add & subtract fractions

- Multiply fractions

- Divide fractions

- Operations with integers

- Mixed operations

- Rational numbers

- Problems solving

- Ratio & proportions

- Percentages

- Measuring units

- Telling time

- Coordinate graph

- Algebraic expressions

- One step equations

- Solve & graph inequalities

- Two-step equations

- 2D Geometry

- Symmetry & transformation

- Geometry measurement

- Data and Graphs

- Probability

Start practice on Sixth Grade here

Why is consumer math essential for 6th-grade students, and how to use worksheets to reinforce it.

Consumer math is the branch of mathematics that deals with topics related to personal finance, such as income, expenses, savings, investments, taxes, interest, discounts, and more. Consumer math is essential for 6th-grade students because it helps them develop skills and habits that will benefit them throughout their lives. Some of these skills and habits are:

- Critical thinking : Consumer math teaches students to analyze information, compare options, and make informed choices.

- Problem-solving : Consumer math helps us solve real-world problems that involve money and resources.

- Communication : Consumer math helps us communicate effectively with others about financial matters.

- Responsibility : Consumer math helps us take charge of our own money and use it wisely.

- Creativity : Consumer math encourages us to find new ways to save, earn, and spend our money diligently.

One of the best ways to learn consumer math is by using worksheets . Worksheets are printable or digital documents that contain questions, exercises, or activities related to consumer math topics. Worksheets can help 6 th graders to practice and reinforce what they learn in class or from other sources.

Worksheets can also help test students' knowledge, check their progress, and identify their strengths and weaknesses. Worksheets can be fun and engaging if well-designed and relevant to students' interests and needs.

Budgeting Basics: How to plan and track your expenses

One of the most essential skills students can learn in 6th grade is budgeting their money. Budgeting means planning how much money you have, how much money you need, and how much you want to spend on different things. Budgeting can help you save money, avoid debt, and reach your financial goals.

To start budgeting, we must understand two things : income and expenses . Income is the money we earn or receive from different sources, such as allowance, gifts, or chores. Expenses are the money we spend on different things, such as food, clothes, entertainment, or donations.

We can use a worksheet, a notebook, or an app to plan and track our income and expenses . We can write down how much money we get and how much we spend every day, week, or month. We can also categorize our expenses into different types, such as needs and wants. Needs are the things we have to buy to survive, such as food, water, shelter, or medicine. Wants are the things we buy for fun or pleasure, such as toys, games, movies, or candy.

By tracking our income and expenses, we can see how much money is left at the end of each period. This is called balance . If the balance is positive, we have more money than we spent. If our balance is negative, we spent more money than we had.

A positive balance is good because it means we can save or spend money on something else. A negative balance is bad because it means we have to borrow money or cut back on our spending.

To avoid a negative balance, we need to plan our spending ahead of time. We can do this by making a budget. A budget is a plan that shows how much money we expect to earn and spend in a certain period. A budget can help us control our spending and ensure we have enough money for our needs and wants.

To make a budget, students need to follow these steps:

- Estimate income for the next month . Students can use their past income as a guide or ask their parents or guardians for help.

- List all fixed expenses for the next month . These expenses, such as rent, utilities, insurance, or school fees, stay the same monthly.

- Subtract fixed expenses from income . This is the amount of money one has left for variable expenses.

- List all variable expenses for the next month . These monthly expenses, such as food, clothing, entertainment, or transportation, change monthly.

- Allocate a certain amount of money for each variable expense category . Students can use their past spending as a guide or ask their parents or guardians for help.

- Subtract variable expenses from the money left after paying fixed expenses . This is the money left for savings or extra spending.

- Review the budget and make adjustments if needed . A child can increase or decrease the amount of money allocated for each category depending on his or her needs and wants.

Saving and Investing: How to grow our money for the future

Another important skill students can learn in 6th grade is saving and investin g money. Saving means putting aside some money for future use. Investing means using some of one's money to buy something that will increase in value over time.

Saving and investing can help us achieve our long-term financial goals, such as buying a car, going to college, or traveling the world. Saving and investing can also help us prepare for emergencies, such as losing a job, getting sick, or having an accident.

To start saving and investing, follow these steps:

- Set a specific and realistic goal for what you want to save or invest in . For example, "I want to save $500 for a new bike by next year" or "Invest $100 in stocks by next month".

- Decide how much money you can afford to save or invest each month . You can use your budget as a guide or ask your parents or guardians for help.

- Choose a safe and convenient place to keep your savings or investments . You can use a piggy bank, a savings account, a certificate of deposit (CD), a mutual fund, or a stock market account.

- Transfer some of your money from your checking account or cash to your savings or investment account every month . You can do this manually or automatically using online banking or an app.

- Monitor the progress of your savings or investments regularly . You can check your balance online or on paper statements.

- Celebrate when you reach your goal and enjoy the benefits of saving or investing .

Shopping Smart: How to Compare Prices and Find the Best Deals

A third important skill students can learn in 6th grade is how to shop smart. Shopping smart means buying the things we need or want at the best possible price and quality. Shopping smart can help us save money, avoid waste, and get more value for our money.

To shop smart, follow these steps:

- Do some research before buying anything . Students can use the internet, magazines, catalogs, or flyers to find out more about the product or service they want to buy. They can also ask their friends, family, or experts for their opinions or recommendations.

- Compare prices and quality of different sellers or providers . Students can use online tools like price comparison websites, reviews, ratings, or coupons to find the best deals. They can also visit different stores or websites to see the products or services in person.

- Negotiate for a better price or a better deal . 6 th graders can ask for a discount, a freebie, a warranty, or a refund policy. They can also use your bargaining skills, such as being polite, friendly, confident, and firm.

- Check the product or service carefully before paying for it . Children can look for defects, damages, or errors. They can also test the product or service to see if it works properly and meets their expectations.

- Keep the receipt and the packaging of the product or service . Your child can use them as proof of purchase or evidence in case they need to return, exchange, or repair the product or service.

Taxes and Tips: How to calculate and pay your fair share

A fourth essential skill students can learn in 6th grade is calculating and paying taxes and tips . Taxes are the money paid to the government for the public services and goods it provides, such as roads, schools, parks, or health care. Tips are the money paid to the workers who provide us with personal services, such as waiters, hairdressers, or taxi drivers.

Taxes and tips can affect our budget and spending decisions. Taxes and tips can also show our responsibility and gratitude as citizens and customers.

To calculate and pay taxes and tips, follow these steps:

- Find out the tax and tip rates for the product or service to be bought . We can use online tools like tax calculators, tip calculators, or tax tables to determine the rates. We can also ask our parents or guardians for help.

- Multiply the price of the product or service by the tax and tip rates . This will give us the tax and tips we must pay.

- Add the price of the product or service, the tax amount, and the tip amount . This will give us the total amount we have to pay.

- Pay the total amount using cash, card, check, or online payment . We can also round up or down the total amount to make paying easier.

- Keep the receipt and check if the tax and tip amounts are correct . We can also write a thank-you note or compliment the seller or provider.

Common money mistakes to avoid in 6th Grade

A fifth important skill students can learn in 6th grade is avoiding common money mistakes . Money mistakes are actions or decisions that can harm our financial situation or prevent us from reaching our financial goals.

Money mistakes can cost us money, time, energy, or opportunities. Money mistakes can also damage our reputation, relationships, or happiness.

To avoid common money mistakes in 6th grade, students need to be aware of these examples:

- Spending more than we earn or have

- Not saving enough money for our needs and wants

- Not investing our money wisely

- Not shopping smartly

- Not paying taxes and tips correctly

- Not tracking our income and expenses

- Not making a budget

- Not following our budget

- Not setting financial goals

- Not reviewing our financial progress

- Not learning new financial skills

- Not asking for help when we need it

- Not being honest about our money situation

- Not being responsible with our money

- Not being grateful for what we have

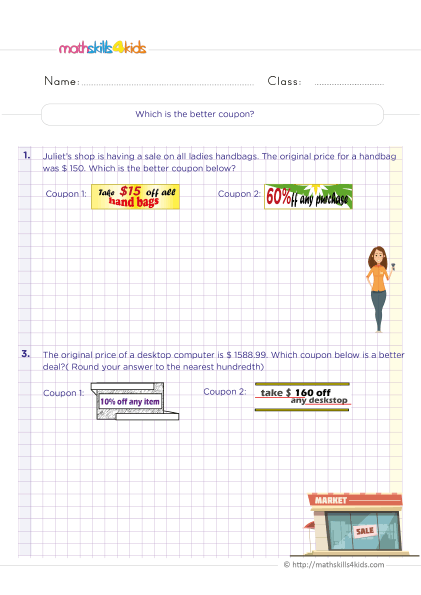

How to compare prices and find the best deals: 5 engaging Mathskills4kids’ exercises for 6th Graders

One of the most important consumer math skills is comparing prices and finding the best deals when shopping. This can help us save money, avoid overspending, and get more value for our purchases. Here are five exercises from Mathskills4kids.com that you can do with your 6th graders to practice this skill:

To compare the prices of different products, we can use the unit price to see which is cheaper or more expensive per unit.

For example, if another pack of 10 pencils costs $2.50, the unit price is $2.50 / 10 = $0.25 per pencil. This means the second pack is cheaper per pencil than the first one.

Exercise : Find the unit price of each product and compare them to see which is the best deal.

- A bag of 20 apples for $5

- A bag of 15 apples for $4

- A bag of 10 apples for $3

- The unit price of the first bag is $5 / 20 = $0.25 per apple.

- The unit price of the second bag is $4 / 15 = $0.27 per apple.

- The unit price of the third bag is $3 / 10 = $0.30 per apple.

Therefore, the first bag is the best deal because it has the lowest price per apple.

For example, if a shirt that costs $20 is on sale for $15, the discount is $20 - $15 = $5. The percent discount is $5 / $20 x 100% = 25%. This means that the shirt is 25% off its original price.

Exercise : Find the percent discount of each product and compare them to see which one has the biggest savings.

- A pair of jeans that costs $40 is on sale for $32

- A pair of jeans that costs $50 is on sale for $40

- A pair of jeans that costs $60 is on sale for $48

- The percent discount of the first pair is ($40 - $32) / $40 x 100% = 20%.

- The percent discount of the second pair is ($50 - $40) / $50 x 100% = 20%.

- The percent discount of the third pair is ($60 - $48) / $60 x 100% = 20%.

All three pairs have the same percent discount, so they have the same savings.

For example, if a book costs $12 and the sales tax rate is 8%, the sales tax is $12 x 0.08 = $0.96. To find the total price, we add the sales tax to the price. For example, if a book costs $12 and the sales tax rate is 8%, the total price is $12 + $0.96 = $12.96.

Exercise : Find each product's sales tax and total price, assuming a sales tax rate of 7%.

- A bike that costs $150

- A helmet that costs $25

- A lock that costs $10

- The sales tax of the bike is $150 x 0.07 = $10.50. The total price of the bike is $150 + $10.50 = $160.50.

- The sales tax of the helmet is $25 x 0.07 = $1.75. The total price of the helmet is $25 +$1.75 =$26.75.

- The sales tax of the lock is$10 x 0.07 =$0.70.The total price of the lock is $10 +$0.70 =$10.70.

For example, if our bill is $30 and we want to leave a 15% tip, the tip is $30 x 0.15 =$4.50. We’ll add the tip to the bill to find the total amount we pay.

For example, if our bill is $30 and we want to leave a 15% tip, we’ll pay $30 +$4.50 =$34.50.

Exercise : Find the tip and the total amount we pay for each service, assuming a tip rate of 18%.

- A haircut that costs $25

- A manicure that costs $15

- A massage that costs $60

- The tip for the haircut is $25 x 0.18 = $4.50. The total amount we’ll pay for the haircut is $25 + $4.50 = $29.50.

- The tip for the manicure is $15 x 0.18 = $2.70. The total amount we’ll pay for the manicure is $15 + $2.70 = $17.70.

- The tip for the massage is $60 x 0.18 = $10.80. The total amount we’ll pay for the massage is $60 + $10.80 = $70.80.

For example, if a pizza costs $10 and we have a coupon that gives us $2 off, we’ll pay $10 - $2 = $8 for the pizza.

Exercise : Find the price you pay for each product or service after using the coupon.

- A movie ticket that costs $12, and you have a coupon that gives you 50% off

- A pair of shoes that costs $80, and you have a coupon that gives you $20 off

- A subscription to an online game that costs $5 per month, and you have a coupon that gives you one month for free.

- The price that you pay for the movie ticket after using the coupon is $12 x 0.50 = $6.

- The price that you pay for the pair of shoes after using the coupon is $80 - $20 = $60.

- The price you pay for the subscription to the online game after using the coupon is ($5 x 12) - $5 = $55.

Bonus: Where to find more resources for 6th-grader Consumer Math

If you want to help your 6 th grader learn more about consumer math and practice their skills, there are many online resources that you can use. Here are some of them:

- gov Free Publications : This website offers a variety of publications on consumer math topics, such as budgeting, banking, credit, identity theft, and more. You can also find worksheets to help your students work through the concepts. You can access the publications here: https://consumer.gov/content/make-budget-worksheet

- Money Prodigy : This article has a lot of suggestions and tips on how to manage our money and become financially savvy. You can also find 19 free consumer math worksheets for middle and high school students on buying plans, discounts, taxes, and more. You can download the worksheets here: https://www.moneyprodigy.com/consumer-math-worksheets/

- Mashup Math : This website has a vast collection of free 6th-grade math worksheets, videos, puzzles, and games that cover various topics, including consumer math. Your 6 th graders can practice fractions, decimals, geometry, algebra, and more. You can access the resources here: https://www.mashupmath.com/6th-grade-math-resources-sneeze

- study.com : This website has a series of video lessons and quizzes on consumer math for 6th-8th graders. They can learn about interest rates, sales tax, discounts, tips, unit prices, etc. They can watch the videos and take the quizzes here: https://study.com/academy/topic/6th-8th-grade-math-consumer-math.html

- Math Goodies : This website has a section on consumer math that covers topics like percent applications, simple interest, compound interest, installment buying, depreciation, etc. 6 th graders can read the lessons and do the exercises here: https://www.mathgoodies.com/lessons/consumer-math

Thank you for sharing the links of MathSkills4Kids.com with your loved ones. Your choice is greatly appreciated.

Consumer math is not just something we learn in school. It is something we use every day in real life. Whether shopping, saving, investing, paying taxes, or making financial decisions, we must use consumer math skills to make smart choices and avoid mistakes.

Some of the benefits of learning consumer math are:

- We can budget our money and track our expenses

- We can save and invest our money for the future

- We can compare prices and find the best deals

- We can calculate and pay our fair share of taxes and tips

- We can avoid common money mistakes like overspending, borrowing too much, or falling for scams

Consumer math is essential for 6th-grade students because it helps them develop financial literacy and prepare for adulthood. By using Mathskills4kids’ 6 th Grade consumer math worksheets and online resources, you can reinforce your 6 th graders’ consumer math skills and have fun at the same time.

WHAT’S THIS ALL ABOUT?

This is mathskills4kids.com a premium math quality website with original Math activities and other contents for math practice. We provide 100% free Math ressources for kids from Preschool to Grade 6 to improve children skills.

Subtraction

Measurement

Telling Time

Problem Solving

Data & Graphs

Kindergarten

First Grade

Second Grade

Third Grade

Fourth Grade

Fifth Grade

Sixth Grade

SUBSCRIBE TO OUR NEWSLETTER

Privacy policy.

Our team Don't Pass on to third parties any identifiable information about mathskills4kids.com users. Your email address and other information will NEVER be given or sold to a third party.

USE OF CONTENTS

Many contents are released for free but you're not allowed to share content directly (we advise sharing website links), don't use these contents on another website or for a commercial issue. You're supposed to protect downloaded content and take it for personal or classroom use. Special rule : Teachers can use our content to teach in class.

For Teachers

Home » Teachers

Budgeting Projects for Middle School Students

Here are our favorite budgeting projects to help middle school students learn how to manage their money.

Your middle school students will thank you for teaching them budgeting skills. The strategies they learn in budgeting projects will help them transition to high school and beyond. When they go in-depth and see how budgets work and apply to their lives, they learn the concept much more thoroughly. Here are some of the best budgeting project ideas for your middle schoolers! Head over to my budgeting lesson plans center for more curriculum tips.

Personal Budget Planning Project

In this project , students learn how to achieve their dream lives and the amount of money needed to support it. They see how to research the homebuying process, find a car, balance a budget, and research careers that can fund their desired lifestyles. All the materials you need are here, including directions on setting up their budgets in Google Sheets, links to career research sites, and more.

Your students probably dream of a lavish lifestyle, and can benefit from seeing how much money it takes to afford it realistically. This project gives students a focus on careers and salaries and helps them in their budgeting skills.

The Average American Budget

This project from Next Gen Personal Finance includes hands-on and kinesthetic activities with multiple components. Students race around the room to match budget categories with dollar amounts, put specific expenses into categories, and see how different budgets work with similar incomes. All the materials you will need are included as links in the Google Doc.

This project will help students grasp crucial budgeting concepts while they compete with their classmates. They see how people’s spending varies and how it is important to stay within your means when calculating budgets.

Class Pet Project

This budgeting project involves your class pet. It focuses on needs vs. wants, showing students how to prioritize spending and saving. You will need a 2-column graphic organizer. On the right side, list all the things the class pet needs to survive, and on the left, list the items that are not necessary but will improve your rabbit or guinea pig’s daily existence. Have kids research the costs and come up with a weekly and monthly budget, using pretend money to pay for basics and unexpected expenses.

Kids – even middle schoolers – will love learning how to care for animals. They will also see how to budget for specific expenses, save for bills that may come up, and determine how wants and needs should factor into their planning.

The Real Budget – Money Management for Students

In this project , students use a combination of research, critical thinking, and math to balance a budget. They fill in worksheets for both short-term and longer-term goals, seeing where they spend most of their money. They learn how to analyze careers and incomes, seeing how they can balance a budget no matter how much they make in the future. The activity takes approximately two weeks and provides many opportunities for independent learning and partner activities.

Many middle-school students see budgets as straightforward, even easy. They think that if someone gets a specific salary, they get all that money and can easily afford expenses in many categories. This project shows them that they need to decrease spending, increase savings, and monitor costs closely to be successful in their budgeting.

Plan a Dream Vacation

Many students love to travel, and this project allows them to plan out the details. They use a wide variety of media to learn about budgets and research travel costs and options, showing them that the process can be fun and challenging. They watch a PowerPoint, use graphic organizers to research destinations and various expenses, and use Google Slides to compile their information.

This project is ideal for middle schoolers who want to learn adult skills and gain independence. Creating specific budgets that allow them to enjoy a stress-free vacation shows how important planning is to a successful trip. They also learn to budget for all sizes of purchases, from tipping the valet to museum entrance fees.

Shopping Spree Project

Your middle school students might enjoy shopping and going to the mall. If so, this project is ideal. They get to control a budget to buy the perfect outfits and clothes from the store. They also learn how to calculate discounts, see the power of comparison shopping, and use coupons. This activity is great for teaching percent while showing kids practical money math skills, and all the materials are simple and easy to understand.

Students see many details as they work on this project that they can learn from in the future. Sales tax, fair pricing, and finding the best deal are all things students gain an understanding of so they can be savvy shoppers.

Summer Vacation Project

This project shows students how to budget for a vacation, given a specific set of activities and expenses. Kids get to pretend they’re traveling to Disney and see the costs associated with the trip, using accurate data they find through research. They record their notes and findings on worksheets and understand how planning for every detail is essential.

The project establishes seven days of vacation, which kids use as they go through the project. They learn valuable skills, including planning for different time periods and discovering where to look for specific travel-related information. This project is ideal for the end of the year as kids get ready to go on summer break, but can be used anytime.

Basics In Building A Budget

Scholastic has an excellent project that teachers can use to show middle school students how to build a budget. The included materials are colorful and engaging, sure to keep your students on task and focused. They also see how and why the math skills they learn in middle school are so key to real life, as they use decimals, fractions, and percentages.

Budgeting is a crucial skill for your learners, and this project will help them get it. It also comes with bonus materials that connect to budgeting and enhance their money education. You can display the included posters and have kids perform various extension activities, giving them an excellent understanding of budgets.

IMAGES

COMMENTS

Jul 8, 2024 · Kid’s Money Budget Worksheet: This worksheet provides students with an intuitive and user-friendly interface, helping them become expert budgeters. (5 th – 12 th Grade) Budget Basics: This worksheet includes a scenario that shows students how to budget for a specific purchase (a car) and how to break savings down monthly. (6 th – 8 th Grade)

Teaching Budget Lesson Plans Learning Worksheet Household Family Planning Exercises Classroom Unit Teacher Resources Activity Free Tutorial Curriculum Basics Lessons appropriate for: 1st 2nd 3rd 4th 5th 6th 7th 8th 9th 10th 11th 12th Graders.

Feb 13, 2024 · Our budgeting worksheet for grade 6 is designed to help students understand the importance of managing their finances while also developing essential math skills. With a variety of interactive activities and real-life scenarios, this worksheet will provide students with the tools they need to make informed financial decisions in the future.

May 8, 2024 · 6 Budgeting Projects for Middle School Students; 4 Budget Projects for High School Students; 11 Teenage Budgeting Tips; How a Teenager Can Improve their Budget; Prom Budget Planner; Alright…let's move on to many more fun budgeting activities with PDFs and financial scenarios for students. Fun Budgeting Activities (with PDFs)

Consumer math is essential for 6th-grade students because it helps them develop financial literacy and prepare for adulthood. By using Mathskills4kids’ 6 th Grade consumer math worksheets and online resources, you can reinforce your 6 th graders’ consumer math skills and have fun at the same time.

Jul 8, 2024 · This project is ideal for middle schoolers who want to learn adult skills and gain independence. Creating specific budgets that allow them to enjoy a stress-free vacation shows how important planning is to a successful trip. They also learn to budget for all sizes of purchases, from tipping the valet to museum entrance fees. Shopping Spree Project